The Federal Reserve will continue its program of purchasing $85 billion in securities and will leave the target interest rate for federal funds untouched to support the U.S. economy, the U.S. central bank said in a policy update issued Wednesday afternoon.

Here's a summary of the state of the U.S. economy from the Fed, which concluded two days of meetings today:

"Information received since the Federal Open Market Committee met in May suggests that economic activity has been expanding at a moderate pace. Labor market conditions have shown further improvement in recent months, on balance, but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has strengthened further, but fiscal policy is restraining economic growth."

To bolster the U.S. economy, the Federal Reserve has spent $85 billion in stimulus measures every month, purchasing a mix of Treasury bonds and mortgage-backed securities. It has also worked to keep interest rates low, in an attempt to encourage borrowing by businesses and households.

Update at 2:44 p.m. ET. No Direct Link To Interest Rates:

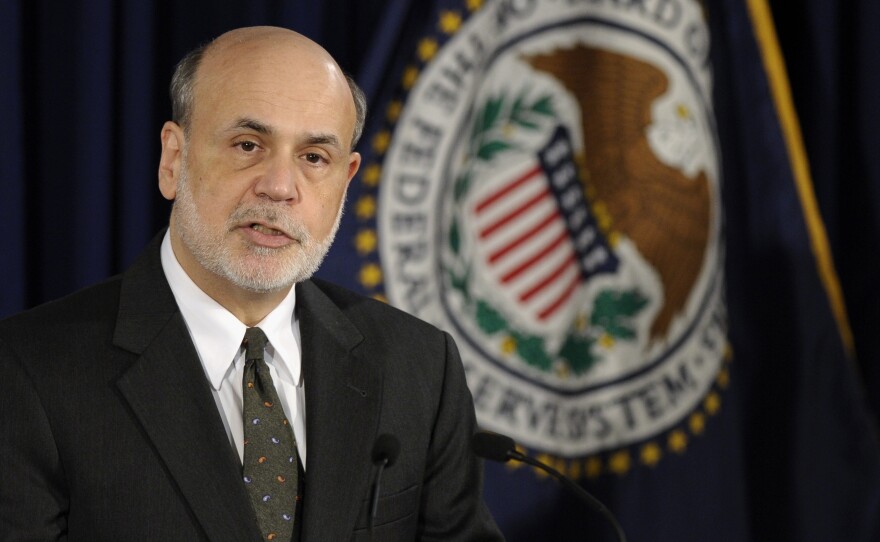

"A decline in the unemployment rate to 6.5 percent" would not automatically trigger a move to raise interest rates, Chairman Ben Bernanke at a news conference following today's policy update.

Bernanke also said the committee could taper off its purchase of securities later this year, echoing a statement he made last month. But he added that the Fed would still hold the securities it has purchased.

In general, the Fed's projections for the U.S. economy were more optimistic than in recent sessions, with policymakers saying they see reduced risks since last fall. That sentiment has led many investors to believe the central bank will indeed begin to ease its pressure to keep interest rates low.

Our original post continues:

The Federal Open Market Committee's statement also said that inflation had remained below the panel's long-term goals, and that there is no reason to believe that will change.

Here's the portion of the release dealing with interest rates:

"In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal."

And here's the part about the monthly purchase of securities:

"To help support a stronger economy... the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month."

Ten of the committee's members voted to approve the new monetary policy; the two votes against were brought by James Bullard, president of the St. Louis Federal Reserve, and Esther L. George, president of the Kansas City Fed. Both cited concerns about the policy's possible effects on inflation.

Copyright 2013 NPR. To see more, visit www.npr.org.