The deal to shut down San Onofre is crafted at secret meetings. The real cost of that controversial deal -- to Ratepayers is billions more than stated. Plus the top boss of the North County transit district faces lawsuits for harassment in age discrimination time Mark Sauer the Roundtable starts now. Welcome to the discussion of the week's top stories I'm Mark Sauer. Turning the other roundtable today are KPBS investigative reporter Amita Charman and Jeff McDonald of the San Diego you can -- Union Tribune. And reporter Brad Racino with inewsource. That's investigative reporters with us today. We will start with you development in a story we recently covered on the Roundtable -- the battle between UC San Diego and USC you over a long-running Alzheimer's study run by UCSD. This week pharmaceutical giant Eli Lilly announced it will move tens of millions in funds for Alzheimer's research from UC San Diego to USC. Earlier I talked with David Waggoner about what this means. David, why did Eli Lilly decide to move the funds for this trial away from UC San Diego? I think they want to stick with the guy they know. His legal fight started when Alzheimer's researcher Paul a sin that this post for a new position at USC. A sin has been closely involved with the trial which is testing a drug on people in early stages of Alzheimer's so these are "brain shows evidence of the disease but who don't yet have symptoms of cognitive decline. The decision here suggest they would rather work with Asan on this trial. How much money are we talking about? Tens of millions of dollars. Lilly pledged up to $76 million to UC San Diego for the trial now they are talking about shifting the dollars over to USC and Asan Paul. What will this mean for the study? UC San Diego officials said they are only losing one piece of the pie. They fought hard to stay in control of the program that oversees the trial and many others. A judge did prevent Paul from taking that such a program with him to USC. So UC San Diego continues to manage the data but they have lost one of the major trials producing the data. This act by Lily strengthens the move to San Diego? I would think it does. It shows that a major drug company believes USC is better staffed for managing this kind of study. Here's what Paul told KPBS went Eli Lilly announced the decision. I believe this is a win for the study for the field. And for the participants who generously volunteered to to join such a study. Going forward it will be interesting to see where other drug companies funding different trials decide to place their money. Thanks, David. Thanks, Mark. We will continue to develop the developments in the conflict. Let's turn to the first topic other roundtable today -- new revelations in the troubled multibillion-dollar deal -- billion-dollar sediment overpaying for the shutdown of the San Onofre nuclear generating Station. The owner is Southern California Edison and the minority is San Diego gas and electric. They closed in January 2012 following a leak and there has been trouble ever since about who would pay the cost for the shutdown. Jeff, let's start with the job for the -- the judge -- what was she looking at? She was looking at a complaint that had been filed by some of the other stakeholders in the preceding that criticized Edison for meeting in secret with some regulators including former president Michael Peevey. That is the meeting from March 2013 over in Warsaw Poland or they sketched out the framework for ideal that was eventually adopted by the commission. That X Partain meeting is not supposed to happen -- that's so so be sunshine on the process? Yes, it is supposed to be done in public. When these ex parte meetings happen they are supposed to be disclosed to the other parties in the preceding within three days so everyone is on the same page and everybody knows who had access to the decision-makers. That's not what happened. They disclosed the meeting earlier this year when state investigators raided Peevey's house and found the notes from the meeting in Poland. So, a long time had passed -- more than the three day limit. Is to some housekeeping -- what is the Public Utilities Commission? 80 a lot of people are not aware of this. It is up was a judicial State Department agency that adjudicates rate hikes for one, electricity, regulate is patient, railroads and the state of California. The mission is to maintain safe and reliable service at reasonable rates. There is a lot of latitude in their mission. The knock in the last year has been that they are overly favorable to the utilities and those they regulate rather than the people and consumers. There's supposed to be the watchdog -- looking out for our interests. And the public interest. So, what violations did the judge file? First, tell us about the judge -- she's not a Superior Court judge, she's a part of the process within the agency. She works for the commission. An administrative law judge. She is the responsibility of any judge and adjudicates different proceedings and they have a number of people on their staff and she is one that got assigned to this case. She was asked to review more than 70 communications that Edison ended up reporting and disclosing. Found that 10 of them constituted formal violations of the X Partain pool. She issued a ruling finding that they had violated 10 occasions this ban against private communications without disclosing them. Tell us about Michael Peevey, the former head of the PUC and his role in all of this. He was the president of the PUC -- a powerful post -- controls tens of billions of dollars in ratepayer spending every year. He was a former Edison executive. When he was appointed there were concerns that maybe he would favor his old employer. That may have proved to be the case with the settlement because he helped negotiate a framework for a settlement for the San Onofre investigation over in Wausau and is now the subject of criminal investigations. Interesting that he's married to a state senator. How did the union Tribune I got about this Warsaw meeting. When the get the search warrant for his house they had to file -- [indiscernible - multiple speakers] -- yes. They filed a search warrant return and on the returns a had a list of the documents that they seized from the home. I noticed when I went through the list of the things that they recovered it said RSG notes on the stationary -- it has to be replacing steam generators. I didn't know where hotel Bristol was but there are hundreds. There's one in San Francisco and San Diego. That is where the PUC lives. We didn't report that they had been at Warsaw until after we reported that the investigation was now reaching into San Onofre because previously it had been in San Francisco which it been responsible for a pipeline that exploded and killed eight people. When they found the notes that linked the San Onofre case to the overall criminal case that the investigator said begun late last year. We started by saying this is kind of an obscure agency for a lot of folks here. Put it into perspective why the secret meetings and it looks like a deal set up behind closed doors -- why is that so troubling? Should it be troubling for the Ratepayers It was done in secret. The job of the PUC is to safeguard power for us to protect the consumer and to safeguard power at a reasonable rate and in a safe manner and to regulate the utilities. In the case of the meeting in Poland it appears based on what Jeff is reported and what other people have reported that Edison had a great deal of power and influence in how this deal was reached and it's interesting -- Jeff hasn't mentioned it but it wasn't until Jeff reported on that meeting in Poland that Edison actually filed a formal ex parte notice about the meeting. That was two years later. Were going to get to that deal in a second break that down. I did want to ask one more question -- the judge herself Melanie darling has come under fire for not going far enough in the ruling -- it sounds pretty dramatic but she has her critics. She has come under fire -- one for not being tough enough and she has only found 10 cases were Edison violated the disclosure rules. She has also come into fire and been the subject of a recusal motion because she's engaged in ex parte communications herself. We reported this in May. I forget when but earlier this year we obtained emails that showed she was trading with Edison executive and discussing the open San Onofre investigation which is unusual to say the least that the judge will be contacting one of the parties in this case. It should also be noted that in the search warrants issued back in June there asking for information on her role in this case as well. So she is a target. Yes, they want her emails. Let's shift to the settlement planets so. It is been under fire for some time -- Amita, explain how the official total of 3.3 billion -- that is what is this is going to cost -- to the utility customers -- vastly understates the actual tab. Is a clip from your report which totals the actual cost. There is about 1 billion for the decommissioning fund that's already been paid less nearly $600 million for the steam generators. Then $3.3 billion in the settlement agreement to cover some of Edison's lost profit from San Onofre. About 5.5 billion for intimate replacement of Disney and plants being built to make up the power generation. If you out of those numbers you get $10 billion. That lays it out fairly clearly here. But he stated cost is only one third of that. How do we get away or to how to the utilities get away with saying it's only going to cost this much to the Ratepayers from that much larger number? We went beyond what is listed in the settlement agreement. We try to add up everything that would cost ratepayers starting with the decommissioning fund. The fund actually began collecting money back in the early 1980s when of the reactors first open. -- 2 of the reactors first open. There has been for two -- $4.2 billion a cumulative in the fund since then. Edison maintains that of the $4.2 billion only $1 billion has been contributed by customers. We could not independently verify that number. We used their number. Then there is another $1.1 billion that we added up that customers would be paying for replacement electricity. In the interim between the time that San Onofre closed and the time that you power plants will be built. A new power plants being built to make up for the lost generation at San Onofre, the cost of that is about $4.4 billion. So again the $3.3 billion refers to the settlement agreement who's framework was developed in secret by former PUC President Peevey and Edison executive they get in Poland in secret two years ago and that has been cast as covering the shutdown cost. It is actually meant to cover or to guarantee that Edison and SDG&E get a rate of return on their investment on San Onofre in San Onofre even though the plant is no longer generating electricity. So, former attorney Mike Geary is tried to get this settlement deal scrapped -- he thinks it's a bad deal for ratepayers. Here's how he described the situation. It's like you bought a car and now the car has proven to be defective see you can to drive the car. And they're saying will reduce the rate on the loan that you took out the thing. So you don't have to pay 5% for the loan you only have to pay 2% and you say wait a second, I don't have the car. Why am I paying for anything? He is mocking the idea that the ratepayer got a refund in all of this. Yes. Edison says it's not just ratepayers playing 3.3 billion they are getting a one billion-dollar refund. The refund doesn't show up on a customer built per se. It shows up as a reduction in the amount of interest that customers are charged on Edison's investment in San Onofre So, it looks to me after reading your stories and looking at all of this as a ratepayer an interested party that we are going to -- the ratepayers -- are going to pay the lion's share under this deal to make these stockholders mostly whole on this. The folks invested in these companies had a choice -- you and I don't have a choice. If you move in -- Edison is your rate supplier and you are stuck with them in your paying for them and you can't go somewhere else. Yet you are going to foot the bill because investors are going to take it. Not only that but the commissioners themselves are almost perfectly unaccountable. If ratepayers have a grievance they can take it to get suffered physical and complain to the PUC but they get ignored. They could take it to the lawmakers but the lawmakers are effective in eating even getting documents when the PC. They can take the complaint to the governor. I have asked the governor's office to weigh in on this and they said they won't talk about it. It's tough to say where a consumer can go for some kind of remedy, but we are supposed to be able to go to our elected officials. And the laws don't seem to apply in this situation. [indiscernible] asked the PUC to turn over documents to compel Edison to turn over emails and other documents concerning how the sentiment was reached in Poland and beyond and he simply hasn't turned them over. They haven't given them to the investigators either. The ratepayers are funding the criminal defense lawyers to the tune of $800 an hour. That's 5+ million dollars. So, it's an unusual situation and I think everybody in San Diego County is waiting for some kind of reaction out of the state house to fix this. We have a short time left. I wanted to get into why people think this deal may unravel. We had some rate payer advocates and consumer group that signed up on the deal. Some have reconsidered. Some are still sticking with it. Explain where we are at. The utility Reform network which is a consumer advocacy group based in San Francisco supported this deal and signed off on the agreement. They have a sense withdrawn their support for what they describe as extensive backdoor communications between Peevey and Edison. Then there is the office of ratepayer advocates a division within the PUC's -- PUC which is supposed to safeguard the consumer interests. I contacted them a couple of weeks ago and said you got this investigation into how this deal was reached. You got all these revelations about these private meetings between Edison and the commission. Are you still in favor of this fax they said yes. There haven't been any indictments. Last word on this -- we mentioned the attorney general investigators were acting on search warrants. Where are we with that? Will we see some criminal action? Who knows? They don't discuss their ongoing investigation. There's plenty of evidence already in the public arena for that to lead someplace at least to have questions asked under oath which would be a nice change. So, I don't know where it's going. I've never encountered such a dysfunctional equation in my journalism career. I would add that Peevey is very powerful in Northern California and he is powerful friends. Where is he now? He lives in an LA suburb. He is retired from PUC and he serves UCLA on advisory board there. He is married to a state senator who is working right now. We look forward to more reporting on this as we move forward. We will shift -- PUC isn't the only agency under fire. NCTD the North County transit to extract has been critical eyes -- criticize and currently being sued by ex-employees. Specific target lawsuit has been the Mark Sauer district Michael Tucker. With the lawsuits -- what are the ex-employees alleging? Matthew Tucker. Sorry. The lawsuits -- 10 -- one in 2012 and one in 2013 and they both allege age and gender discrimination when it comes to hiring and firing. The latest one by a former employee, Virginia molder, alleges she was unfairly targeted for layoff and was not rehired for internal policies that mandate people laid off have priority when it comes to rehiring. And how many now besides her? How many ex-employees are cleaning discrimination and bullying? There have been 2 lawsuits. In the most recent one -- there were no former managers -- to former managers that alleged seeing the same thing and witnessing the same kind of behavior by Mr. Tucker. There was a massive turnover of NCTD employees. A lot. We tried to get a tally of how many and we came up against a roadblock. They wouldn't give us the documents so we try to piece it together. Over the years it looks like since we took it from when Matt took arrived until now it looks like a few dozen and these are high managers -- in charge of running the train control and grants and contracts and safety. And a lot of these people have turned over multiple times -- there is one position for ADA disability oversight that turned over five times in two years. In and out constantly. These people are paid hefty severance when they leave -- they have to sign agreements so that they can't not talk about the time. There also be replaced by people that are being found to have hunting firms. There is one of particular that NCTD likes to use a lot that is costly -- 30,000 or $40,000. This is happened time and time again. This is because of the turnover. Until now it has been hard to get them to talk -- they cite confidential settlements and legal actions. Where to the new revelations -- go to spotlight shone on some of the specifics. Where do they come from? This comes from the lawsuit. The first time we had managers say these things on the record. In depositions. In the years of reporting we talked to a lot of people will be But their names to a because they would lose the severance packages. It's the first time -- there have been times in the past always gotten a couple of employees who it told us that we also got a confidential resignation letter that was submitted in 2012 by the district chief technology officer that late this out as well. Same allegations and age and gender-based discrimination and harassment. That's how we have peace this together. What does Matthew Tucker say about the allegations? We try to get into common he won't talk to us. He hasn't for a long time. The lawyers responded and said their side is that in the motion which is an quarter which seeks to dismiss what the managers are saying -- they are disgruntled. Disgruntled ex-employees. Whatever they say has no bearing and it can be proven. They don't believe them to be factual statements. Has pretty much it. Of course, this is an agency that is overseen by a Board of Directors. Supervisors. Looking out for the public interest, presumably. What is the Board of Directors say? For every story we've done we've reached out to them -- 8 representatives -- electorate representatives -- the North County district. Bill horn is on the board as an alternate. We've only had people who whatever responded. Tony Krantz and Mark Aguilera. In the recent story Mr. Krantz wrote to us and said he will not be commenting on this but he will -- he wants -- once it works its way through court -- overall we haven't heard anything from any of these people. No matter what we ask them they will never respond. They won't go on the record. They won't talk to us. Is there any evidence they are doing anything in closed suction to reconsider the choice of Mr. talker as their executive? The only evidence is that he gets a lot of bonuses and raises. What are the specifics on that? Think it's about -- he was guaranteed $10,000 raises every year for the next four or five years. He is making 270,000+ a $20,000 bonus. No evidence they are looking at anything and this speaks a lot to how the boards are structured. These are people who may be put in an hour or two a month looking at these agencies. They are doing their own stuff in their own cities. To come into these gigantic agencies and try to see what is going on at all different levels, I don't know if they have the capacity or time to do that. I'm not making excuses I'm just saying -- They only know what the staff tell them. You been covering NCTD for a couple of years and you uncovered flaws -- can you list the high points? We started to cover them in 2013 but it was in 2012 when they went through FDA review of federal transit the ministration every three years -- they monitored compliance with grant activities. North County gets a lot of grants and they have to abide by certain rules. They come in an audit them and they found were deficiencies in 2012 than at any point in history. That same year the contract department was audited by a contractor that they had -- they found deficiencies all over the place and that's important because North County when talk of came in he said he is changing it from a transportation agency to a contract manager agency. He laid up 80% and almost everything is run by contractors. They are oversight and manage it and their staff is 120 people when it was five or 6P The hub that oversees that was found to be deficient in almost every area that the contractors looked at. The next year in 2013 it shut down for months. Then we also found that the district's security force was completely untrained and unprepared for anything they were doing. They audited the contractor and found it to be true and gave them in order to comply with however much time audited them again and found they still had complied and that the molten really dollar contract. This year they did another review and found even more deficiencies than in 2012. It's even worse than at any point in the history. The list goes on. We believed -- we will look for more reporting and followers. This wraps up the KPBS Roundtable. I would like to thank like guests -- Amita and Jeff and Brad. A reminder -- all of the stories we discussed are available on the website. KPBS.org. I'm Mark Sauer. Thanks for joining us on the Roundtable.

Edison facing fines from CPUC

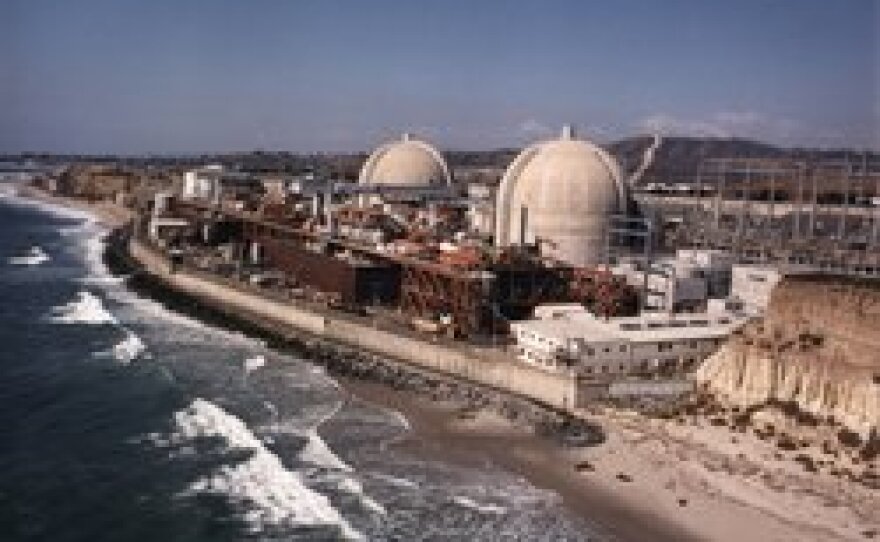

A judge for the California Public Utilities Commission determined Wednesday that Southern California Edison, majority owner of the failed San Onofre Nuclear Generating Station, violated rules forbidding backchannel communications with regulators.

Edison executives met or communicated with former CPUC President Michael Peevey, among others, at least 10 times over a settlement plan to pay for the closure of the San Onofre Nuclear Generating Station.

The judge gave Edison less than two weeks to show why it shouldn’t be held in contempt and fined for crafting the deal in secret with the state agency that was supposed to regulate it. The deal was outlined at a secret 2013 meeting in Poland.

Peevey and Edison officials are the focus of a criminal investigation into how the San Onofre settlement was reached.

Former San Diego City Attorney Mike Aguirre is suing the CPUC and Edison to try to overturn the settlement, and several consumer groups have called for the deal to be reopened.

What closing San Onofre really costs us

The controversial $5 billion settlement over the shutdown of the San Onofre Nuclear Generating Station lists the tab to ratepayers as $3.3 billion over 10 years.

But customers have already paid $1 billion of a $4.2 billion decommissioning fund to handle the toxic nuclear waste. So does that $1 billion count toward the shutdown tab? Well, no.

The $3.3 billion covers the profit Southern California Edison and SDG&E would have earned had San Onofre remained open for the next 10 years.

The settlement deal states that customers of Edison and SDG&E must pay for power they would have bought and power they must now buy elsewhere because San Onofre is off-line.

That cost is estimated at $1.1 billion for five years, making the total cost to ratepayers around $10 billion over the next 10 years or so.

Southern California Edison argues customers are getting a good deal because their rates didn’t go up. And if it prevails in its $7.6 billion lawsuit against Mitsubishi, the makers of the faulty generators which were the catalyst for the plant's closing, it says it will share the proceeds with ratepayers.

NCTD dealing with age, gender discrimination suits

Former managers and employees of the North County Transit District have been deposed in a lawsuit filed against the district for age and gender discrimination.

They allege that Matthew Tucker, the agency’s CEO, harassed and bullied older female employees. He is alleged to have stated that it was “one of the perquisites of power” to hire younger women who were “easier on the eyes.”

Filed by former NCTD HR employee Virginia Moeller, the suit is the second in two years alleging NCTD failed to protect its employees against Tucker.

The agency argues the declarations are irrelevant, inadmissible and untrue. In a deposition, NCTD’s former financial manager said he had addressed these complaints with Tucker, who repeatedly said he thought it unlikely the board of directors would find out.

NCTD has endured layoffs, firings, shutdowns, deficient transit reviews and scathing audits since 2009, the year Tucker was hired.

The number of employees alleging age and gender discrimination is now at six.