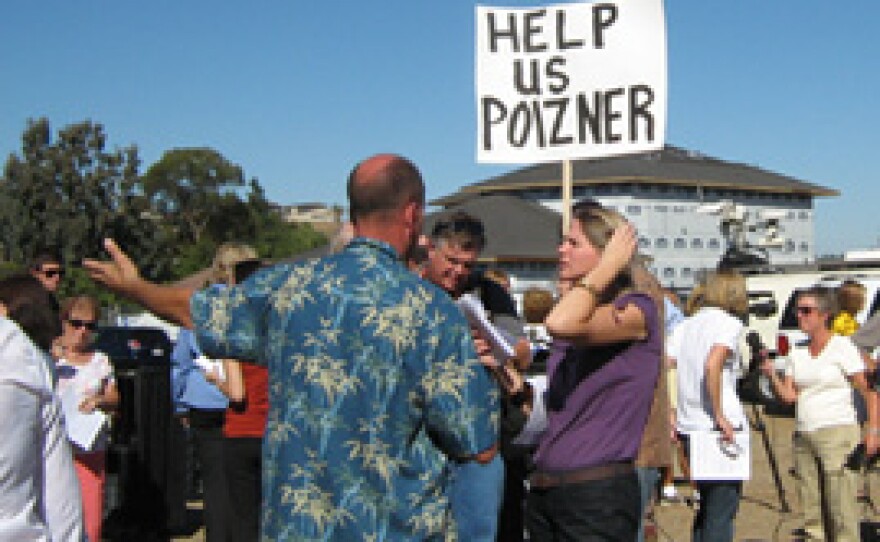

(Photo: A group of families who lost their homes in last year’s fires but have still not reached a settlement with their insurance companies. They ‘re calling on California Insurance Commissioner Steve Poizner to push for legislation to reduce the problem of underinsurance. Alison St John/KPBS )

Fewer than one in ten of the homes that burned down last October have been rebuilt, and the most common reason is that the homeowners found they were under-insured. A group of under-insured homeowners is calling on California’s Insurance Commissioner to take action. KPBS reporter Alison St John has more.

Stephen Stout lost his home in Rancho Bernardo last October. He says he’s had to itemize every fork, spoon and baby picture he lost and he still hasn’t settled with his insurance company.

He joined advocacy group, United Policy Holders, to call on Insurance Commissioner Steve Poizner to change the dynamics of the insurance marketplace, that often leaves people unwittingly underinsured.

Stout: He needs to follow through on his promise to all of us who are undersinsured through no fault of their own, we as policy holders are not asking for anything we did not pay for.

Poizner says he has received only 106 complaints statewide involving underinsurance, and he’s recovered $2.6 million for San Diegans who were underinsured.

But he acknowledges there’s a problem, and he says he is working on a package of legislation that would include more disclosure about the limitations of policies.

Poizner: That will hopefully once and for all bring to closure this problem of every time a community burns down, construction costs spike and people find themselves underinsured, or they’ve just been outright misled by their agent or broker.

Poizner says guaranteed replacement policies were phased out after the Oakland fires. He says the new coverage requires clearer communication between insurance agents and their clients.

Alison St John, KPBS news