There are growing concerns that the economic recovery is fading and the U.S. could slide back into recession -- the so-called double dip. Recent economic data suggest the housing market is already doing just that.

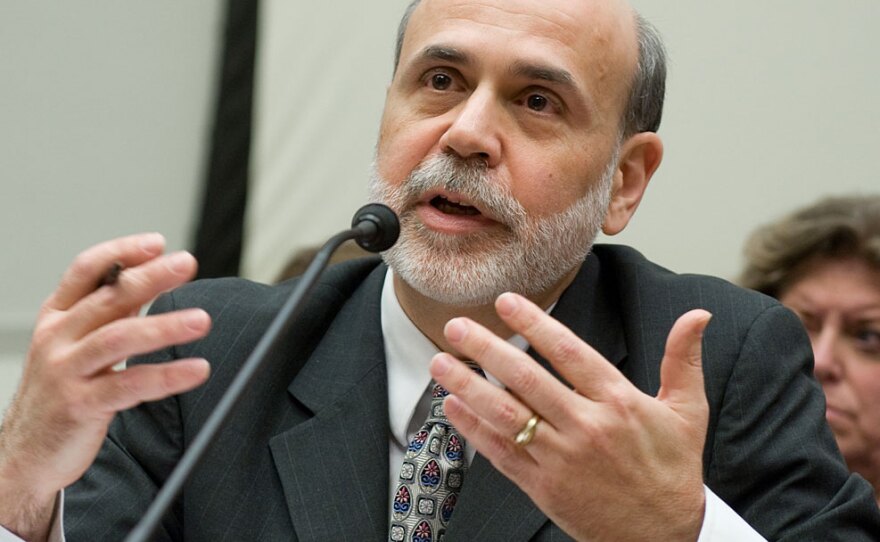

Investors and economists are worried. They're hoping that Friday at a Federal Reserve conference in Jackson Hole, Wyo., Chairman Ben Bernanke will signal new Fed action to shore up the economy.

This week's news that existing homes sales fell 27 percent caused many to grab their worry beads and start recalculating the odds of a return to recession.

Sung Won Sohn, a former chief economist at Wells Fargo, says the mess in the housing market, along with stubbornly high unemployment, have caused him to raise the odds of a double dip to 40 percent in his economic forecast.

"So I think the government, both the Obama administration and Chairman Bernanke, need to take some additional action to make sure that we do not slide into another recession fairly soon."

Sohn, who's now a professor at California State University, Channel Islands, says one problem to address is the lack of credit available to small- and medium-size businesses.

"Even when the economy seemed to be doing better earlier this year, small- to medium-size companies were really suffering, so perhaps we can do something to help them out in terms of getting credit, and then help them hire people," he says.

Alan Blinder, a professor at Princeton and former vice chairman of the Fed, says one way for the central bank to help small businesses is to quit paying interest on the trillion dollars in reserves that banks have on deposit at the Fed.

"And, in fact, you don't have to stop at zero; you could actually charge banks for the storage privilege," he says. "The idea is to free up some of this money and get it out into the marketplace. And hopefully some of it finds its way into new bank lending. That's what we really need."

Blinder hopes Bernanke will signal that the Fed is ready to do that in his speech Friday. Blinder also suggests that the Fed could tell bank regulators, who are being tougher in the wake of the financial crisis, to ease up a bit on healthy banks and encourage them to make more loans.

These moves might not have the power of an interest rate cut in normal times, but Blinder says the Fed is running out of options.

Copyright 2022 NPR. To see more, visit https://www.npr.org. 9(MDAzMjM2NDYzMDEyMzc1Njk5NjAxNzY3OQ001))