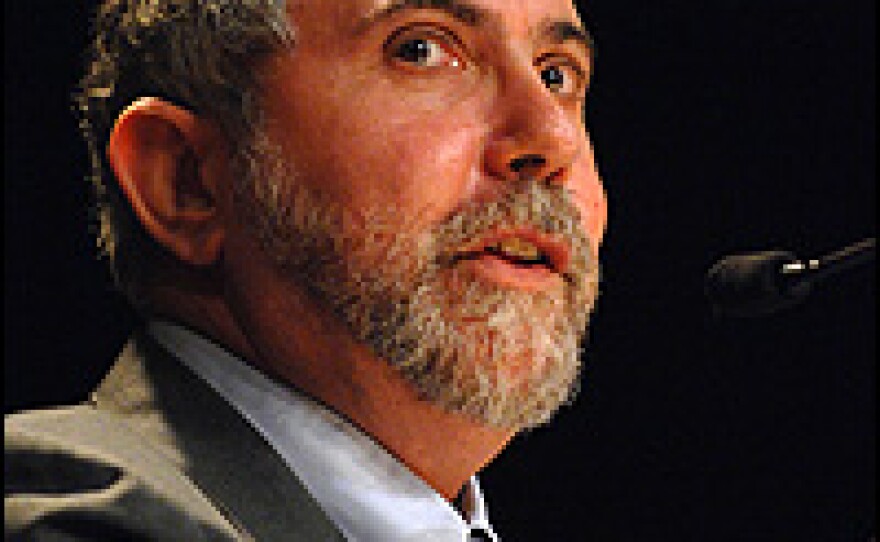

The Nobel Committee has awarded its annual prize for economics to New York Times columnist Paul Krugman.

Krugman, who is well-known for his biting criticism of the Bush administration, is also a professor of economics and international affairs at the Woodrow Wilson School at Princeton University. His academic work on international trade was the basis for the Nobel award.

Speaking to Michele Norris, Krugman, 55, says he "had no anticipation" he was getting the award, which he called "an awesome surprise."

"I was stark naked, about to step into the shower at 20 minutes to 7 and my cell phone rang," he says.

The Nobel committee cited Krugman's work on formulating a theory that answers questions about how economies of scale affect international trade.

"What we did was we took a view of international trade that said that really countries trade with each other because they are different: One country is tropical. Another one is temperate. One produces coffee and the other produces wheat.

"We said, 'Well, that's part of the story. But there's also a lot of trade that's taking place because somebody gets a small head-start in some industry and that builds into a cumulative advantage because of the various economies of scale.'"

He says that the work presented "a very different view of globalization and it came at a time that the world was getting more global. So it has turned out to be very relevant."

Krugman also discusses the global financial crisis, noting that he and others are "scrambling to understand what's happening and come up with answers."

"I should have" seen it coming," he says. "I berate myself for not understanding the extent to which we have these financial domino effects. I saw there would be a burst bubble and there would be a lot of pain, but I didn't realize how big the pain would be."

Krugman blames former Federal Reserve Chairman Alan Greenspan for much of the crisis because, he says, Greenspan ignored warnings about the economy.

"In retrospect, how could we have been so blind?" he asks. "We created a financial system that basically outgrew the defense we created back in the 1930s to protect against crises. We should have understood that because the system had outgrown those defenses, there was the possibility of another one. But very few people saw it coming."

Copyright 2022 NPR. To see more, visit https://www.npr.org. 9(MDAzMjM2NDYzMDEyMzc1Njk5NjAxNzY3OQ001))