The Poway Unified School District may be California’s poster child for exotic school bond financing, but it is by no means alone in San Diego County.

As I detailed in my story yesterday, Poway Unified borrowed $105 million last year using a form of financing called a capital appreciation bond. The district won’t start making payments on the loan until 2033, and by the time it’s paid off in 2051, taxpayers will have paid back almost $1 billion, or almost 10 times the original loan.

As I point out in my story, capital appreciation bonds have become increasingly popular across the state, since they allow school districts to borrow money now without raising taxes on current residents. Instead, the burden for paying for the bonds is pushed to future generations, who are left on the hook for loans that are wildly more expensive than conventional bonds.

I’ve been digging through public records to try and find some other examples of these bonds in San Diego County. I haven’t come across anything quite as extreme as Poway’s deal, but I have found some bonds with very similar rates of interest and repayment schedules.

The deals elsewhere in the county mirror Poway’s deal in other ways, too. All three districts had recently passed bond measures to complete previous renovation and modernization efforts that were behind because of cost overruns and delays.

The three bond measures, passed in 2008, all made the same promise to voters: Tax rates would stay the same.

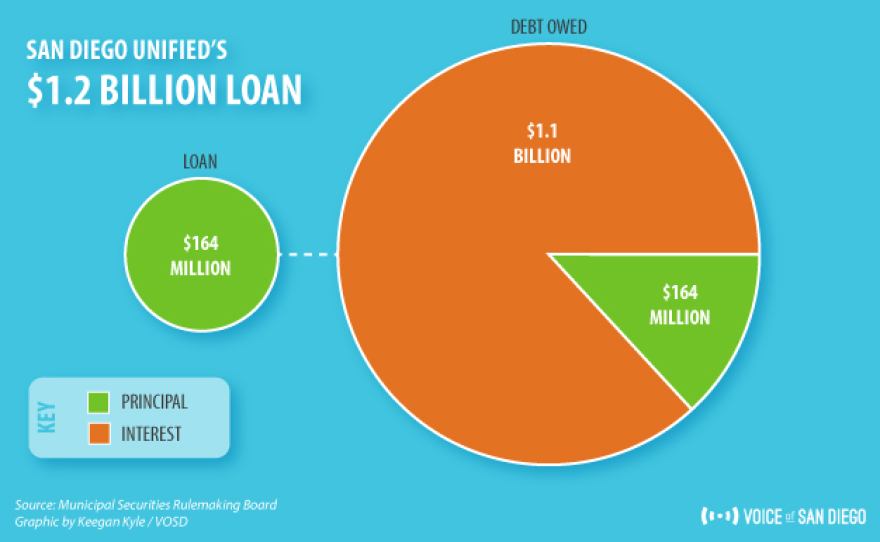

San Diego Unified — Borrowed: $164 Million. On the Hook For: $1.25 Billion

In 2010, the county’s largest school district borrowed almost $164 million from investors using capital appreciation bonds.

The loan was part of 2008’s Proposition S, in which voters approved the district to borrow more than $2 billion to complete district-wide renovations and modernization.

Just like Poway, San Diego unified won’t start paying back those bonds for 20 years. The first payment is due in 2030. By the time the loan is fully paid back, in 2050, San Diego taxpayers will have paid back $1.25 billion, or about 7.6 times what the district borrowed in the first place.

That’s much more expensive than a typical school bond which, like a home mortgage, is paid back every year of the loan. In a more typical bond, a district would pay back two or maybe three times the total amount of the initial loan.

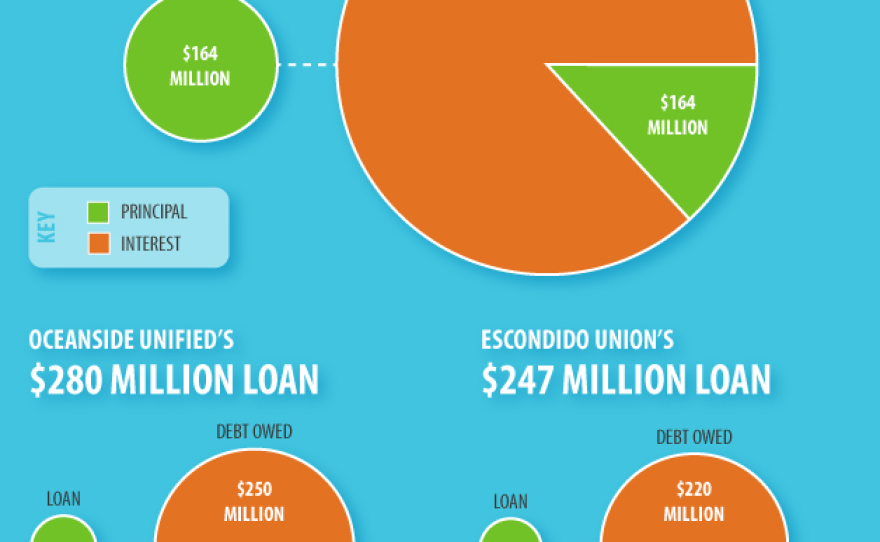

Oceanside Unified — Borrowed: $30 Million. On the Hook For: $280 Million

Further north, in Oceanside, the payback ratio for taxpayers is even bigger, though the district’s loan is significantly smaller.

Oceanside Unified borrowed $30 million in 2008. By 2049, the district’s taxpayers will have paid back almost $280 million. That’s more than nine times what they originally borrowed.

Escondido Union — Borrowed: $27 Million. On the Hook For: $247 Million

Escondido Union School District has a similar deal.

The district borrowed almost $27 million in 2009 using capital appreciation bonds. Taxpayers in the district will pay back almost $247 million by the time that debt is paid. Again, that’s more than nine times the initial debt.

Making the Same Deal

Apart from their sheer cost, there are other stark similarities between these three deals and Poway Unified’s 2011 bond.

All three districts passed bond measures that paved the way for their capital appreciation bonds in 2008.

And, all three of those bond measures were floated for the same reason: To finish off previous bond programs that had been started in the districts years before but hadn’t yet finished because of cost overruns and delays.

All three districts also promised voters their tax rates wouldn’t increase to pay for the new swath of borrowing. As I explain in detail in yesterday’s story, the same promise of steady tax rates led Poway Unified to seek out this creative form of financing.

There’s one more similarity between two of the three deals and Poway’s deal: The San Diego County Taxpayers Association gave its backing to the bond measures that paved the way for both San Diego Unified and Escondido Union’s sales of capital appreciation bonds.

The association didn’t back Oceanside’s bond, saying the ballot language for the bond was too vague.