As the San Diego Opera prepares to possibly shut down at the end of this month, its contracts with General Director Ian Campbell and his ex-wife, Ann, may be one of the company’s biggest liabilities.

But a former head of the Internal Revenue Service's nonprofit division told KPBS that it’s not just the potential for severance payouts that could be problematic.

Marcus Owens, now an attorney in Washington, D.C., said the "very generous compensation packages" given to the Campbells could raise questions with legal authorities.

“I think the state attorney general will be giving the organization a call soon,” Owens said.

The opera board is to meet Friday afternoon in what some directors and staff see as a last-ditch effort to make a new way forward before the April 29 deadline for selling off the organization's assets and closing the opera company.

A group of board members hopes to persuade fellow directors to rescind the vote to close the company. Among them will be board member Carol Lazier, who this month pledged $1 million to the cause and flew to Dallas last weekend to discuss ways to reinvent the company with leaders of other opera organizations.

Meanwhile, local opera management is regrouping.

Board president Karen Cohn sent out what she called a "manifesto" Thursday citing the opera’s commitment to transparency and a pledge to review alternatives for the company as quickly as possible. The opera posted a library of documents on its website, including 990 income tax forms, bylaws and audits.

Also included was a letter from the opera’s attorney, saying he has advised the opera not to pay any severance to the Campbells if the organization closes and enters into a formal legal liquidation process. Instead, he said, the Campbells will have to get in line with other unsecured creditors, such as the singers who have contracts with the company.

“They (opera directors) should stop the clock ticking on this April deadline because no person or organization makes good decisions under pressure,” said Pat Libby, director of University of San Diego’s Institute for Nonprofit Education and Research.

Ann Campbell taught fundraising in the program for many years, and Libby considers her a friend.

Five-Member Operations Team Named

Earlier this week, Cohn sent a memo to opera staff members and the board saying an operations team of five, including herself and the Campbells, would be making decisions and public statements for the company.

In 2011-12, the opera board approved changing the definition of a quorum to 10, even though there are more than 50 members. That troubles Owens, the former IRS official.

“That’s extraordinary,” Owens said. “It appears that the structure is designed to facilitate control by a small group of people, and there is a small group of people who seem to be deriving extraordinary benefits from the organization.”

Unless the opera's closure is stopped, its $15 million in assets will be sold off and debts settled. Who is first in line to get paid will be determined by an assignee, a third party who will manage the sale of the assets and then pay the creditors according to legal priorities.

Secured creditors are paid first, then unsecured creditors, which includes the singer contracts and employee contracts. The American Guild of Musical Artists, the union that represents solo singers and chorus members, has at least 35 contracts with San Diego Opera, for seasons as far out as 2017. The union has started the legal process to have the opera company’s assets frozen to ensure their singers get paid.

The Campbells' compensation packages have been center stage in the weeks since the opera board voted to cease operations of the 49-year-old company.

The contracts specify base pay, health and retirement benefits, and cars. Supplemental retirement benefits and executive health care after retirement are also mentioned.

The Campbells' combined base pay exceeded $1 million in 2009-2010.

Compensation Packages Questioned

Owens, a lawyer who spent 10 years heading the nonprofit division of the IRS, questions the scope of the benefit packages.

“When I look at the employment agreements, which contain some extraordinary provisions, and I look at the latest 990, (the opera’s tax return), what I see is an organization that has entered into some very generous compensation agreements with two people and not with anyone else,” said Owens, who is with the law firm of Caplin and Drysdale in Washington, D.C.

Owens and other experts in nonprofit management who spoke to KPBS also questioned that Ian Campbell signed his ex-wife's contract as deputy director in 2013. No clause is in her contract stating that her former husband should not be involved in her performance evaluations or contract negotiations.

“When you have a relationship like that you want to take as many precautions as possible to make sure it is squeaky clean,” said USD’s Libby. “The more people who know about the process and the contract as possible in the organization the better.”

When the IRS tests for reasonableness of compensation, Owens said, it looks not only at benefits to individuals but also those going to family units. The Campbells were married for 27 years. They divorced in March 2013.

Federal laws governing charities are in place to make sure the assets of an organization are not used for the benefit of those who run it, Owens explained. These include rules that require a nonprofit to conduct salary comparison studies for its most highly compensated employees.

Charities need to operate exclusively for charitable purposes, otherwise an organization can lose its tax-exempt status, which provides a key incentive to contributors.

“There are federal tax laws looming here given the benefits and compensation paid to the general director and the deputy general director,” said Owens.

Here are key provisions of the Campbells’ compensation:

Ian Campbell's Base Pay, Other Benefits

Ian Campbell has worked at the opera for 30 years. His current contract, signed in 2006, calls for a base salary of $365,000 to be paid through December 2017. From 2015 through 2017, that would be nearly $1.5 million.

The opera’s 990 tax forms indicate Campbell has received raises over the years. For example, according to tax filings for 2011-12, the latest available, Campbell’s salary was $508,021. Whatever his salary is now, that is what he will be paid through 2017, according to the contract.

If it’s still $508,021, that’s at least a $2 million liability for the company.

Campbell’s raises are supposed to be decided by a six-member compensation committee. That committee is chaired by longtime board member Faye Wilson, an expert in corporate business management and a “Life Director” of the opera.

Sources with first-hand knowledge of opera finances told KPBS that Wilson is the only person who reviews Campbell’s compensation. Wilson and the Campbells are close friends.

Tax laws require the company to measure the general director’s salary and compensation package every three years against those of his counterparts at organizations of comparable size and in similar markets. The company has to report that information to the IRS, which the opera did in two sections of its 2011 tax forms.

The compensation committee has yet to provide meeting minutes to a group of board members or to KPBS. Both have asked for a list of financial and governance documents.

Marc Scorca, president of Opera America, a national umbrella organization, said proportionate to the size of the company’s budget, “Campbell is the most highly compensated general director among our largest opera companies.” Some general directors have higher salaries, but their companies are much larger.

KPBS media partner inewsource compiled compensation data from the tax returns of opera companies across the country that are comparable by various measures to the San Diego opera.

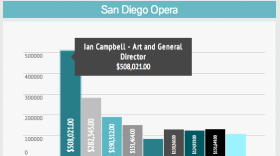

Campbell’s total compensation was $508,021 in 2011, making him the second-highest paid employee among the six operas analyzed. Ann Campbell was the second-highest paid employee at the San Diego opera with total compensation of $282,345.

inewsource found that San Diego Opera spent a total of $1,712,518 in compensations for directors, officers and key employees listed on the tax forms, slightly more than the Houston Grand Opera’s $1,706,859. San Diego opera employed 406 individuals during 2011, fewer than half of the 825 employees at the Houston Grand Opera.

The Houston opera's top paid employee was the art/music director, who made $400,577, and its second highest paid employee was the general director, at $359,661.

Other benefits given to Campbell under his contract include:

• He is eligible for “executive” health care after his retirement. That figure will likely be determined by an actuary who will decide on a dollar amount based on health information and life expectancy.

• The company is required to make premium payments for two life insurance policies, totaling $1 million in death benefits, through 2017.

• The opera will pay the premium on his retirement fund through 2017. The policy pays Campbell $107,000, tax free, per year beginning in March 2012 for a period of 15 years, totaling $1.6 million. If the retirement payments take a hit on the markets and fall below the agreed $107,000, the company has to make up the difference.

• The company purchased a 2010 Audi for Campbell. His contract says the opera will pay for insurance, maintenance and operating costs.

Campbell’s contract will be looked at far more closely as the company winds down and dollar figures will be attached to some of the clauses. Owens said the amount of money Campbell would stand to gain “is significant enough that he could afford to hire an attorney and sue if he doesn’t get what he wants.”

Ann Campbell's Employment Agreement

Ann Campbell, as the opera company's deputy director, makes a base salary of $280,513 under the employment agreement signed and approved by Ian Campbell in 2013.

She has a company car, close to seven weeks of annual vacation and when she leaves she’ll receive 18 months of her base salary, or just over $400,000.

Owens said, “Eighteen months is pretty darn generous. ... Normally people are paid three months or six months.”

The agreement calls for reimbursement of “all reasonable expenses.” It contains no details, and the opera has refused to provide KPBS with expense accounts and credit card payments requested for the past five years.

Ann Campbell is also eligible for a supplemental executive retirement plan.

The Campbells’ employment agreements both contain “kick-out” clauses. If either is fired “for cause,” their benefits are dramatically reduced.

Contributing to this report were inewsource investigative assistants Emily Burns and Leo Castaneda.

This story was edited by Lorie Hearn, executive director and editor of inewsource, a KPBS media partner.