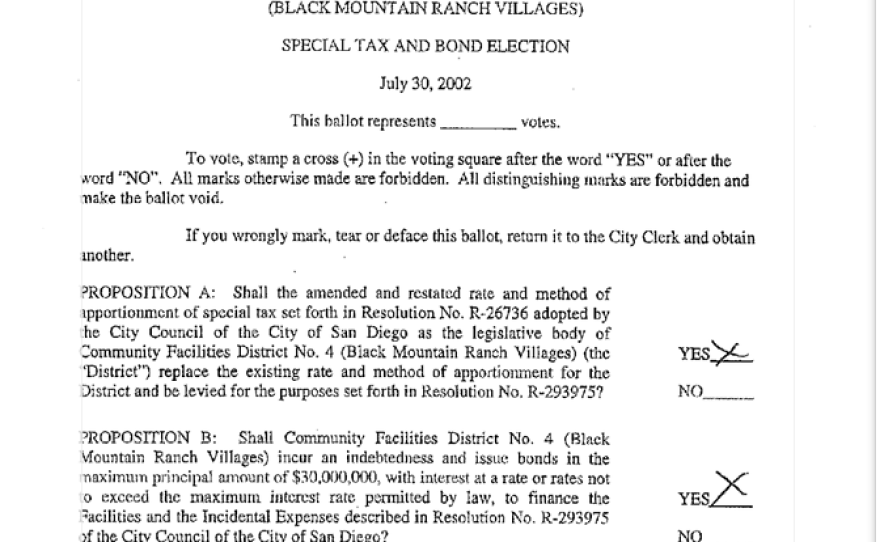

On Nov. 21, 2000, Harlan Friedman marked an "X” on a ballot giving the city of San Diego the power to issue $25 million in bonds and charge hundreds of homeowners thousands more in property taxes.

CAVANAUGH: Of the arcane taxes and fees California homeowners are faced with Mello Roos taxes are probably among the least understood. An inewsource investigation into why the taxes exist how they are created and who pays them has been rolling out of the last few weeks on KPBS radio, TV and perhaps most dramatically on the KPBS website. There you can see an interactive map to find out if you are in a Mello Roos district. I'd like to welcome two inewssource reporters who worked on this story. Joanne Faryon, welcome, Joanne. FARYON: Thanks, Maureen. CAVANAUGH: And Kevin Crowe who is now a journalist with the Milwaukee Journal Sentinel and Kevin welcome to the show. CROWE: Thank you for having me, Maureen. CAVANAUGH: Joanne, I think the only way many people are familiar with the term Mello Roos is about real estate boards used to advertise and know Mello Roos. What are the taxes where do they come from? FARYON: It all started back in 1982 after California passed Proposition 13. Quick reminder on Prop 13 is basically limited increases in property taxes but also said to local jurisdictions that you that you can't create new special taxes unless you get a majority vote of the people, so that is really where Mello Roos came from. So in 1982 would have legislators who come together to create this law that says look now we have expansion in the state we are building all these new neighborhoods. We haven't got the money necessary to build the roads and schools the developers hope of paying the costs we have to figure out a way to pay for it so it allows in these new developments it basically developers landowners to come together to form what is called the financial district where whoever owns the land in the district gets to vote and say we want to introduce this new tax. CAVANAUGH: So it helps the developers get the money they need to build the schools and build the roads and new developments that the cities or counties are not going to be able to find for the new developments. Now, do the developers therefore through the use of the tax pass that cost on to homeowners? FARYON: This is what makes it really difference is that when the developer comes into a neighborhood and does this the vacant land to turn it into a neighborhood, they actually build the infrastructure first. They don't sell the homes and then using that taxpayer for the infrastructure they put in the infrastructure first and the recent variable to do this in most Mello Roos tax districts the developer together with the city or school district or whatever governing body he or she has joined forces with they will issue bonds, tax exempt bonds to raise the money. People invest in these bonds, so that may have the cash, they build whatever it is that is needed and then the Mello Roos taxes that homeowners are paying you’re paying the interest to those investors who invested in the bonds. So you pay after-the-fact. CAVANAUGH: Got it and this is in addition to the regular property tax that you would pay, is that right? FARYON: Right and one of the reasons the law is so misunderstood is when you get the property tax bill from the County treasure it does not say Mello Roos if you pay it will not say that you will see 1% and that is 1% of your purchase price. That is property tax that's what prop 13 did you only pay 1% of the purchase price for ever and ever it can go up but not by more than 2% then you probably see a list of things like mosquito abatement, something about water, $20, $10, then if you see something CFD community facilities District because that is the real name of Mello Roos, that is the legal name, you will see that and it might say 800, it might say 8000 and you might see more than one. Chances are you will see more than one because people in the new developments, the districts usually pay into more than one dollar resource CFD community facilities District. So that is I think part of the misunderstanding is the tax bill, the way you see it is very confusing. CAVANAUGH: The bonds ever get paid off, do the taxes ever go away? FARYON: Yes, by law the bonds have to be paid off there has to be an end date, Kevin can probably speak to this when it first started out people are using CFD or Mello Roos tax districts even in the 90s even of the lot has been around since 82, in the mid to late 90s, the end dates for these bonds are usually like 20 years, 25 years. We are seeing a lot could go 40 years, 50 years, so we are trying to figure this one out to so even if the bonds have an end date the tax district still can issue other bonds, they can extend it, it's very convoluted, but there are indicates and typically we are seeing 30, 40 in some cases you can see 50 years. CAVANAUGH: Kevin, you crunch the numbers on who is paying what when it comes to Mello Roos, first of all RDs community facilities districts, the CFD Mello Roos districts are they clustered in certain areas in San Diego County? CROWE: Yes absolutely, so they are out, as Joanne said, kind of in the newer developments, so there are a ton in the Poway area, Sweetwater, Chula Vista there are not a lot in older areas because they count on an absence of voters in order to get their taxes past, so you see a lot of them for the Poway unified school District Sweetwater had something like 17 and I think they just filed for any teens, recently. So it's kind of in not northern eastern areas of the county. CAVANAUGH: How much are homeowners paying for Mello Roos in San Diego County? CROWE: That really varies there are some places that pay summer for few dollars for fire protection District, then there are places that they may be $8000. They might be paying back to the Poway Unified School District. MAUREEN CAVANAUGH: Now Joanne, you located some homeowners who were apparently paying too much in the taxes, tell us about that. FARYON: As Kevin mentioned this is a new area of development and it actually is Mello Roos our community facilities District and the city of San Diego, so just imagine off the 56 Freeway, the Camino Del Sur exit, in that area there's a lot of new development thousands of new development houses being built so the city actually has a CFD that includes 346 homes. So I just have to speak to Kevin's map again. We are talking about the data, and Kevin really helped to create this amazing interactive map, where when you going you can see what you are paying and what your neighbors are paying, so because of this map what we saw and what other homeowners I was these people are paying more than the person next door to them more than anyone in the neighborhood. We did some digging, a lot of digging and found out that their taxes were based on incorrect square footage. I was right on the building permit. Because of that the city is now saying we are going to refund this money because it was thousands of dollars in one case two years, another case for years, and we're going to fix your tax bill and we will look at all the other properties in the district to find out if maybe there taxes around, too. CAVANAUGH: So the taxes should be based on square footage of the property? FARYON: That’s the thing, Maureen, just when you think you've got it figured out you haven’t really got it figured out. So in that tax district it's based on square footage, but it's not necessarily the case all the time when these districts are formed as Kevin mentioned they are formed early on in the development process before you know you may want to live there so this one particular text district was formed in 2001, people did not move until 2008. So, when is formed and they start to issue bonds, then all of the rules have to be established. So the rules of how much are we going to charge, that's when they set up a table, a chart but until you go right into those documents, those formation documents, you don't know. So we can save the documents that we've looked at for certain tax districts yes it was square footage but we don't know if it might be based on something else in other districts and we are in the process of trying to figure this out right now. CAVANAUGH: Now Kevin, how much is the County taking from Mello Roos taxes? CROWE: The County just collects it so the County tax I think it was somewhere around $195 million and it's been over $100 million for a number of years now so the County tax collector collects taxes, but then redistributes it to all the districts, so you know, Sweetwater gets their share, Carlsbad gets their share, Poway gets there share, the city of San Diego you know if they are running CFD, they get theirs. CAVANAUGH: Joanne, does this money stay in the community is or does it go out to pay the interest on the bonds? FARYON: It depends for the most part. Kevin maybe can add to this, but my sense is out of the CFTC floated most of them are paying interest on bonds, they've generated bounce but you can form a tax district without issuing a bond and you can collect the money for service, for fire service or library service you can have one of these tax districts issue no bonds and collect money and pay for the service. CAVANAUGH: One of our listeners called in, Joanne, and wants to know if homeowners are aware of the Mello Roos tax when they buy? FARYON: Is it has to be disclosed especially when you go to new developments and we've gone to them and him and out they say you pay this much money so absolutely in the title of this series is Mello Roos a tax you choose because the argument a lot of people make is you pay this buy this house, you know. With an extra tax and look what you are getting a new road, or maybe a school that was recently built. So absolutely, I don't think the series is trying to apply imply that somehow people don't know that they are paying it, the series is trying to come I think there is a lot of misunderstanding in terms of what it is, how much it is, where the money goes, how long you have to pay. CAVANAUGH: Kevin, Joanne has given us a feeling for this but let me ask you because in one of the reports Joanne mentions you've been crunching reports on this report for months. How difficult was it to find out the Mello Roos tax structure in San Diego? CROWE: There are a ton of people who really want to talk about it very much there are people who know about it but there typically attorneys and developers and maybe they don't have a ton of interest in talking to news reporters about it. But the County for its part was very forthcoming with all the tax information so as soon as we could figure out what we needed to ask for from San Diego County they came out with property by property information pretty quickly. But, if you were to call the state and you call the state treasurer's office and all those folks, nobody has a lot of answers when it comes to accountability. So, you know how much you are paying, but it is hard to track down exactly where it goes. CAVANAUGH: And Joanne? FARYON: I want to build on the point Kevin is making because, City Council passes a budget or when the state passes a budget what they're doing is trying to decide how to spend the tax money. All the money they have in the state and the city those are the taxes they are spending this is another tax that for about 30 years various districts, jurisdictions sort of had the power to levy. But we cannot media coverage, we have not coverage on what is the rate, what is the interest that the bonds are generating, how long am I paying it, where is it going okay but to build a school and a road, just a road going to cause me okay we know, all the checks and balances that are in place currently when states pass budgets yet, this growing pool of tax money, there is very little coverage and what we are discovering as Kevin said we want to make a question about oversight and accountability is going to take us a while to sort of get there we are sort of building the story as we go but ultimately that is where we want to land. CAVANAUGH: You know Joanne one of the most disturbing parts of your report was rolled out today generally speaking after proposition 13 it takes a two thirds vote of the people in order to enact a new tax but when it comes to Mello Roos because we are talking about undeveloped property it is a whole other ballgame. FARYON: It's exactly the way the law was designed to sell again to remind listeners, prop 13 says people have to vote when there is this new local tax. So there still has to be a vote when you have a Mello Roos tax because that is the law. Basically what happens let's say I'm a developer, I own a bunch of land and I want to build houses. The city has a plan or whatever city you live in the county will say if you want to build their you have to make sure this road goes through and you have to put in some sort and the school district says you're going to have all these new kids we can build the school we don't have any money so you have to do something to help us out. So the law says that you still have to go into this area and say are there any area because his deformity and tax districts of the developer or the city or county could the County registrar and they say this is the land we are talking about, how many registered voters there. We actually looked at all the files going back to 94 that the County registrar had for these formations of these districts and found that in the vast majority there were zero registered voters something of 220 or 200 of them something like that there were zero voters because there were no people living there, vacant land the losses if there aren't any registered voters, the landowner votes so let's make the distinction between a public vote and a landowner vote. So who is the landowner? Often it is the developer so quite literally what will happen is there will be a ballot that says we want to turn this area into a district and we will issue some taxes and one person we have a copy on our website of a ballot and 1% marks an X and that is the election, and the district has been approved with the blessing of the city or school district and going forward that tax was levied this is a standard this is the norm and it's perfectly legal. CAVANAUGH: That's fascinating and that's how as you say the people who live in those areas, they say they know they are informed that they are paying the tax but they never got to vote on it. I'm wondering can eight tax be changed let's say when a people move in or amended anyway? FARYON: The only way I'm aware of is first of all the jurisdiction I call the city or school district whoever oversees the tax district can oversee the bonds if that was 6% announcer percent they can refinance and the taxes go down they are not obligated to buy log but they can do that so if you are paying one of these taxes you should find that out the second thing is when you move into the house you can pay off your Mello Roos that. Let's say it was going to be $2000 a month for 30 years with interest. They can so you know what instead give us 40,000 or 50,000 whatever it amounts to, pay upfront now and you don't have to pay this those are the only two ways I'm aware of that you can have an impact on the tax. CAVANAUGH: Well, Kevin Crowe and Joanne thank you so much I've been speaking with formerly journalist for inews source with the Milwaukee Journal Sentinel I want everybody to know please go online KPBS.org check out the stories there and this interactive map. You will find out about Mello Roos. Thanks again. FARYON: Thanks Maureen CROWE: Thank you

Friedman was the sole voter in that election. At the time, he was a consultant for Black Mountain Ranch, a developer in north San Diego. A state law, the Community Facilities Act, commonly called Mello-Roos, gave Friedman the power to solely decide whether the city could levy the new tax.

Friedman’s vote has so far impacted 346 property owners in Del Sur, an upscale development in Community Facilities District (CFD) 4. Mello-Roos adds an average of $3,545 in extra property taxes a year to each home in this Mello-Roos district. The city began reviewing those bills after an inewsource investigation found two homeowners were being overcharged.

The vote was not a momentous moment in Friedman’s life. He said he’s helped create as many as 10 Mello-Roos districts in San Diego and Riverside counties.

“I don’t remember voting or not voting,” he said.

A landowner vote versus a public vote is standard in forming Mello-Roos districts, according to an inewsource analysis of county voter registration records. It’s a typical -- and legal -- sidestep around Proposition 13, the tax-limiting law passed by the voters in 1978 that mandated all new local taxes designated for specific purposes, like schools, are subject to a public vote.

Here’s how Mello-Roos works:

Let’s say a developer owns vacant land somewhere in San Diego and wants to build 1,000 new homes. The city requires the developer to pay for the roads, water and sewer lines and other infrastructure needs. The school district in the area can also ask the developer to help build a school.

Mello-Roos allows the developer to form a CFD with either the city or the school district or both. A CFD can issue bonds and collect special taxes that will pay for the new roads and schools. And it requires a vote.

But most proposed developments don’t have residents, and the Mello-Roos law says if there are fewer than 12 registered voters in a district, then only the landowners vote. Sometimes it’s a single landowner, or the landowner's agent, like Harlan Friedman, who casts the only vote.

When residents eventually move into the neighborhood, the Mello-Roos tax is disclosed.

“When you buy the house, you take on the obligation [of Mello-Roos],” said SDSU real estate lecturer Mark Goldman. He added, “It's not like people in the neighborhood can get together and vote not to have Mello-Roos. It’s already in place.”

inewsource examined CFD records provided by the San Diego County Registrar of Voters dating back to 1994.

“When a CFD is being formed, the local government body or one of their representatives comes to our office to determine how many individuals, how many registered voters live in that proposed area,” registrar Michael Vu said.

In total, there were 244 requests mostly from cities and school districts for voter information for new or expanded CFDs. Of those, 209 had no registered voters in the district. Only 10 had more than 12 voters.

If the CFD is formed with only a landowner vote, the registrar is no longer involved and keeps no further record of the CFD process.

There are currently 232 CFDs collecting taxes in San Diego County. inewsource was able to trace voting records to at least 120 of them. Of those, 113 had no registered voters when the request for voting information was made.

According to a summary of the Mello-Roos law, if a proposed CFD has fewer than 12 registered voters in the 90 days preceding its formation, the landowners are the only voters.

CFDs collected nearly $200 million in Mello-Roos taxes in San Diego County last year -- $80 million went to three school districts: Poway Unified School, Sweetwater High and Chula Vista Elementary.

The highest concentration of properties paying into Mello-Roos are found in areas of expansion, such as North County and Chula Vista. Many of those neighborhoods pay into more than one CFD or Mello-Roos district.

For example, in Del Sur, the neighborhood where Friedman’s vote led to the taxation of hundreds of homes, homeowners also pay into a Poway Unified School District CFD.

Friedman says Mello-Roos is a fair tax because the developer is “saddled putting (in) all this infrastructure.”

“The homebuyer gets all the infrastructure on day one and they should pay for it,” he said.

Find out if you’re in a Mello-Roos district and whether you’re paying this extra tax by going to our interactive map at www.kpbs.org/taxes