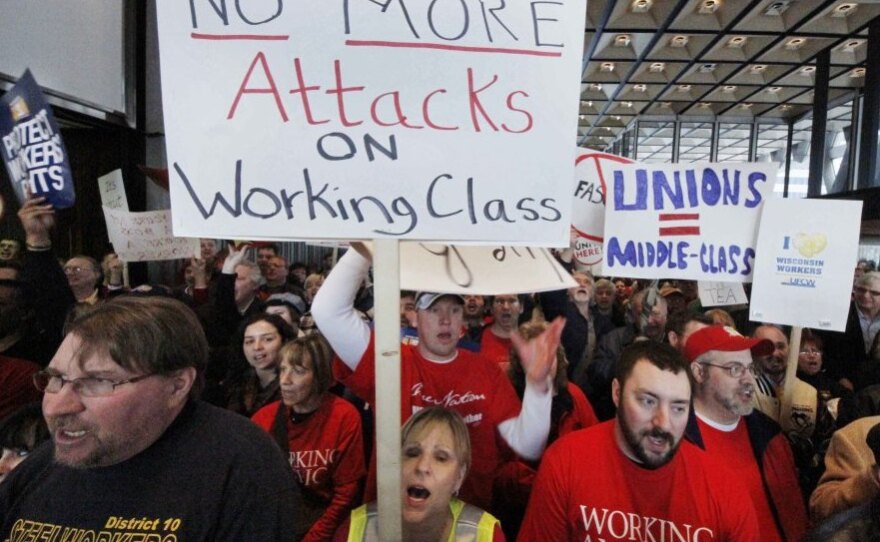

The budget showdown in Wisconsin and other states has brought to light the differences between public and private retirement plans.

Olivia Mitchell, executive director of the Pension Research Council at the University of Pennsylvania's Wharton School, tells NPR host Renee Montagne that people in the private sector have pension envy because it seems their public sector peers are getting a better deal in retirement.

But that envy may not last long as state and local governments struggle to pay for those benefits.

"There have been many efforts to try to compare the compensation of private and public sector workers and typically the results show the public sector workers do get paid more, not only in terms of wages and salaries, but especially in terms of retirement benefits [and] heath care benefits," Mitchell says.

She says it's hard to make the direct comparison because people in the private sector may be earning higher wages and salaries, but public sector workers have much more generous benefits including early retirement, and better job security that affords more of a "well-cushioned lifestyle."

Given the state of the economy, many people remain concerned about traditional defined-benefit pensions in which an employer promises to provide a stream of income for retirees until they die. These plans can also cover spouses. To meet this promise, Mitchell says, the employer and frequently the employee make contributions to the plan.

"The problem is that in many states and many cities those contributions have not been made over the years," she says. Another problem is that the contributions that were made were heavily invested in the stock market, which hasn't performed well. And everyone is living longer.

So the money is running out.

The city of Philadelphia has underfunded liabilities of about $17,000 per household. In New York it's $39,000, and in Chicago it's $42,000.

A $3 Trillion Problem For States

"It's going to take about a quarter or perhaps a third of Philadelphia's annual city budget just to pay retiree benefits," Mitchell says. "The reality is it's a huge problem. And the states — it's been estimated — have an underfunding level of about $3 trillion. It's really a problem across the board."

A number of states have tried to make inroads to solve this problem. Illinois raised its retirement age for public workers from 60 to 67 and New Mexico raised the number of years of service required for its pension from 25 to 30.

"But the reality is that we still have this enormous hole," Mitchell says. "And instead of being 30 years off, it's facing us today."

Copyright 2022 NPR. To see more, visit https://www.npr.org. 9(MDAzMjM2NDYzMDEyMzc1Njk5NjAxNzY3OQ001))