MAUREEN CAVANAUGH: Prop 29 on the June ballot. That is the new cigarette tax is holding a slight lead in a new Field poll. This is KPBS Midday Edition. Proposition 29 would raise California taxes a dollar a pack of cigarettes. The money going mainly to cancer research. But Californians have been ambivalent about cigarette taxes in the past and this measure has drawn a lot of criticism. We will hear from both sides. In an unusual move the case against a marijuana co-op is dismissed by a San Diego judge and our weekend preview will be a treat for people who love art, music, dance and horses. I'm Maureen Cavanaugh. KPBS Midday Edition is next. First the news. It's a fight to the finish over California's proposition 29 which would increase the cigarette tax. And a mistrial and dismissal in the case against a San Diego medical marijuana co-op. This is KPBS Midday Edition. I'm Maureen Cavanaugh. It is Thursday, May 31. Here are some of the San Diego stories we are following a KPBS newsroom. The average price of a gallon of regular gas in San Diego dropped slightly today to $4.27. The price is about $.10 more than one month ago and $.25 higher than one year ago. The guided missile frigate USS Kurtz will depart San Diego tomorrow for its final deployment before decommissioning. The Navy plans to decommission the Kurtz next year after nearly 30 years of service. Listen for the latest news through the day here on KPBS. Our top story on Midday Edition is the controversy over state proposition 29 on the June 5 primary ballot. Prop 29 would increase the state tax on cigarettes by a dollar per pack. The state tax will generate about $75 million a year the bulk of which would be dedicated to fund cancer research although antismoking measures are generally supported by a majority of Californians cigarette taxes have not always been popular with voters. Polls show a majority of Californians say they will vote yes on prop 29 but support for the measure has been going back and forth. Joining us to present the case for and against prop nine are our guests, supporter Debra Kelly, she's director of advocacy and health initiatives for the San Diego American lung Association. Debra, welcome back to the show. DEBRA KELLEY: Thank you, Maureen. MAUREEN CAVANAUGH: And her opponent is Jennifer Jacobs. She's from the Americans for prosperity, a conservative political advocacy organization and welcome, Jennifer. JENNIFER JACOBS: Hey, thanks for having me. MAUREEN CAVANAUGH: Debra, let me start with you. How do they Californians will benefit of prop 29 as pass. DEBRA KELLEY: Well in a lot of ways. First of all about 100,000 kids will actually, actually 200,000 kids will be prevented from smoking. We are going to save about 100,000 lives. Our long-term medical care costs the taxpayers pick up for treating tobacco related disease will go down by $5.1 billion. So it is really for acid is about saving lives, it's keeping kids away from cigarettes and it is about helping people who smoke quit. MAUREEN CAVANAUGH: Can you break down for us how the proceeds from the tax will be used? DEBRA KELLEY: Yes certainly. So essentially a pack of cigarettes will cost a dollar more $.75 of that will go into research and cancer heart attacks emphysema diseases that are caused by smoking another $.20 will go into programs that keep kids from smoking and help people quit. Three cents will go to law enforcement to help us enforce that tobacco control act and administrative costs will be capped at two cents. MAUREEN CAVANAUGH: our current taxes on cigarettes already going toward cancer research? DEBRA KELLEY: Yes absolutely. About a nickel actually is going toward cancer research. MAUREEN CAVANAUGH: but this sounds like it would boost it, is that the idea? DEBRA KELLEY: It will boost it substantially and what it's really going to do is make California the second largest funder of cancer research in the United States and we are going to become the epicenter of cancer research. And people live in California are going to have access to the best treatments. All kinds of clinical trials. It's going to be a phenomenal benefit to all of us here in California. MAUREEN CAVANAUGH: Jennifer Jacobs, does your organization Americans for prosperity, does your organization opposes tax because it is a tax and you don't like taxes, or is there something specifically about prop 29 that you are against? JENNIFER JACOBS: In particular we believe that this entire proposition is flawed and that in a time when the state of California is in a $16 million budget deficit, when $20 million has been taking on of education over the last four years, that to create a whole another bureaucracy that has layers and layers of no taxpayer protections and that allows the money collected in the state of California to go out of California when we have an 11% unemployment rate right now, this money could be spent anywhere out of California anywhere actually outside of this country without any taxpayer oversight. There's not even legislative oversight. This creates a whole new bureaucracy that is filled with political appointees were not going to have the sense to be able to spend it any way they want and today more than ever taxpayers need to be assured that if they're going to raise taxes, if they're going to have money being spent it needs to be spent in California for California taxpayers and first and foremost we need to make sure that the healthy families programs, the education programs, we have teacher layoffs right and left right here in San Diego County and yet this does nothing to address the budget deficits of the state of California. MAUREEN CAVANAUGH: You know cigarette maker Philip Morris is spending a lot of money on ads opposing this Texan that's enough right there to make people vote for prop 29. My question, Jennifer is why should people who really hate smoking, who want to see lives saved, opposes prop 29? JENNIFER JACOBS: Listen, I've never smoked a cigarette in my life so this has nothing to do with any text that's going to affect me personally. What does affect me as a taxpayer is just one more special interest tax that allows the state of California and the Sacramento politicians to be unaccountable for the money that is collected by, collected in taxes and we just have runaway spending in the state. And the last thing we need is one more text that creates another slush fund for Sacramento politicians and there is no guarantees in there. There's no oversight, there's no legislative protections. There's not even a mandate within this proposition that says that a taxpayer Advocate has to be appointed to the commission that is going to be deciding where all this money goes. MAUREEN CAVANAUGH: Let me have Debra, let me have her respond to this. And again, one of the criticisms of prop 29, Debra is that the state can't touch the bulk of the money raised for any other purpose but cancer research, they can't even touch it for cancer treatment. Why was the bill written like that? DEBRA KELLEY: Partially the bill was written that way because they want to protect the money from the politicians. There certainly is a history of elected officials setting up their own slush funds etc. This is written in such a way to prevent that. You know listening to Jennifer's statements I really feel like I'm listening to the Marlboro woman. She's really spouting all of the lies and best representations that are being promulgated by the top tobacco industry and I will .21, this whole thing about the money could be spent outside of California and for people who are close to a Californian I want you to go to section 2 on prop 21 and look at the statement of purpose. And you will see the two paragraphs in order for us to research in California. One or first California research facilities and the third subparagraph refers to reducing tobacco use in the state. So, this is very clear. It's unambiguous. The money is going to stay here in California just as our current tobacco-related disease research program, that money stays here in California. So that's just a lie. JENNIFER JACOBS: It is absolutely not a lie. MAUREEN CAVANAUGH: California Senate President Don Barada crafted the bill does not say that there's any guarantee the money is going to stay here in California. I mean that's one of the things you have to deal with, right, Debra? DEBRA KELLEY: I think University of California did its own analysis on the Board of Regents voted to support and they agreed the monies going to stay here in California. Now is it possible that somebody's going to buy a piece of equipment that they can only get from New York?absolutely is going to allow common sense things like that but research award or a program award be made to an institution outside of California, no? MAUREEN CAVANAUGH: What about the specific requirements for who could be on the newly created board Debra that will be distributing the money. Isn't this creating a new level of bureaucracy as the critics claim? DEBRA KELLEY: Well this new level of bureaucracy is basically going to be a nine person panel and it's going to consist of three chancellors from the University of California, three directors of the National Cancer Institute funded cancer control programs, a physician, associated with an academic medical center and then to patient advocates. So I think this is exactly the kind of oversight and accountability that we need. These are Nobel laureates. These are people who understand research, understand the kind of decisions that need to be made to keep kids from smoking, to help people quit. So I'm very comfortable with this the last thing I would want to do is turn this over to the state legislature. MAUREEN CAVANAUGH: Jennifer, Debra says the bill will save lives is that reason enough to vote for it? JENNIFER JACOBS: Does this legislation actually say we guarantee that you will save a life? Really does it say that? Let's just talk about the taxes she brought up before that'll be five cents WriteNow of the cigarette taxes that are in the state of California go to any of the things that she wants them to go to. Isn't that enough that you should be concerned about creating just another tax because all the politicians in Sacramento, and she can call me names all day long, all I'm hearing is more defensive Sacramento politicians who have By the Way, Dennis into a $60 billion deficit hole where we have teacher layoffs, $20 billion in unfunded education, where we have healthy family programs not being funded. What makes us so sure that we could trust any of them. By the way all of these people being appointed to this commission, political appointees by Sacramento politicians. That's, and that is enough right there. You can say all day long that we hope that these people will be this that the other, but at the end of the day it is one more place for political appointees by Sacramento politicians to put their friends into positions where they get salaries and the slush funds and there is nothing in this that says that it guarantees that the money is going to stay in California. MAUREEN CAVANAUGH: I'm curious though because of the organization that you are with, Jennifer, can you see any scenario where your organization would support an additional tax on cigarettes? JENNIFER JACOBS: At this time in the state of California we don't support tax increases at all MAUREEN CAVANAUGH: Of any kind? JENNIFER JACOBS: Until the Sacramento politicians get there by gently the same way I have to have my house and land the same immigrant who's almost 90 years old has to balance his budget he was just saying to me the other night over dinner how when they have impeccably taken as much as they paid and he wasn't talking about this, he's just talking about he looks at government today and he says where do they think they're going to get the money from and we've got to tell the Sacramento politicians that enough is enough. You've got to live within your means, you've got to do the programs on the table with the money that you have and stop frivolously spending on things that don't go to help the people of California. MAUREEN CAVANAUGH: Just to be clear if you are buying cigarettes you will be paying the tax JENNIFER JACOBS: I don't think that that is specifically true DEBRA KELLEY: I have to say yes it is JENNIFER JACOBS: You're going to tell me right now the tax is only on cigarettes? DEBRA KELLEY: It's only on cigarettes and tobacco products. JENNIFER JACOBS: You said it's only on cigarettes MAUREEN CAVANAUGH: if you don't smoke or chew tobacco you're not going to be paying. JENNIFER JACOBS: What my concern is one more tax, one more slush fund. We can talk about high-speed rail. We created a whole mother/funded gets what's happened with that? It's never enough money. All of a sudden you went from 7,000,000 to 110,000,000,000 (inaudible) what it is today. MAUREEN CAVANAUGH: Let me get Debra back into the conversation. After health complaints a state appointed doctor who appeared in ads opposing prop 29 was dismissed by Gov. Jerry Brown. That was a little chilling to some observers, even people who support the idea behind prop 29. You think that might have hurt your case? DEBRA KELLEY: Well, I don't think so actually the last letter that went from came from Lieut. Gov. Gavin Newsom as far as we're concerned issue is not the Dr. I think the issue is the misrepresentation physicians are in general opposed to this in fact it's been endorsed by the California medical Association, the California Hospital Association. The governor actually dismissed all of Gov. Schwarzenegger's appointees at once so that was his decision. MAUREEN CAVANAUGH: You also lost the support of a number of editorial boards across the state like the LA Times, the North County Times who have claimed okay, what they claim is, if it could cause but it's a poorly written proposition how do you respond to that? DEBRA KELLEY: I think that it's actually a very well written proposition. And, obviously PLA time argument was a little mystifying to us because they talked again about you know, the budget deficit the tobacco tax is not going to have anything to do with the budget deficit one way or another. I really is an immaterial argument so one of the things that you look for in initiatives is, will the money that you raised be spent in accordance in other words, in the money that we are going to race from taxing tobacco products is going to be spent on programs that will help people who use tobacco products, their kids, if those folks are really any of us come down with any kind of tobacco related disease. So I think that you know it is unfortunate that the LA Times took the position he did. We had the endorsement from every other major newspaper around the state including the San Diego Union Tribune. MAUREEN CAVANAUGH: Let me ask you Jennifer, if this proposition does not pass who wins besides Philip Morris? JENNIFER JACOBS: You know the taxpayers when, and I will tell you why because it's just one more time that the taxpayers are saying you've got to get your house in order. You've got to stop the frivolous spending. You need to fund the things that Californians need with the money that you have and it is there. And I mean we have to make sure that the things that are guaranteed in the Constitution now that are supposed to be fun that are being funded. I mean, we've got you just saw an article yesterday about the 9/11 license plates, where the funds were going to help antiterrorism and help fund scholarships for the kids that had parents who were affected by the 9/11 attacks. And they've rated the entire account. So, how do we know that they won't read anymore or anything else if you are telling me right now and she just said that that only five cents of all the tobacco taxes right now are going to the things that she thinks is important DEBRA KELLEY: Excuse me, Jennifer, now, I was asked how much of the current tobacco tax is actually going to tobacco-related research and that's five cents. I agree with the other uses of, certainly the prop 99 fund. So please don't misrepresent what I say. MAUREEN CAVANAUGH: I think one of the criticisms actually is not necessarily that it's going to be that these funds are going to be rated but that they cannot be rated because if the voters vote for this particular proposition they cannot, they can only go to the specific and they cannot be used by the general fund of California. So I mean people who are against and people who are for this proposition both say that is something to talk about. I have to end it here. We are out of time I want to thank you both very much for being great spokespeople for your particular causes. Debra Kelley director of advocacy and health initiatives for the San Diego American lung Association and Jennifer Jacobs with Americans for prosperity. Thank you both very much. DEBRA KELLEY: Thank you for having us. JENNIFER JACOBS: Thank you.

Television ads about Proposition 29, the cigarette tax initiative, can be confusing.

The state ballot measure would increase the tax on cigarettes in California by $1 a box to fund cancer research and anti-smoking campaigns. About $735 million a year would be generated from the measure, with $468 million annually going to cancer research, according to the California Legislative Analyst's Office.

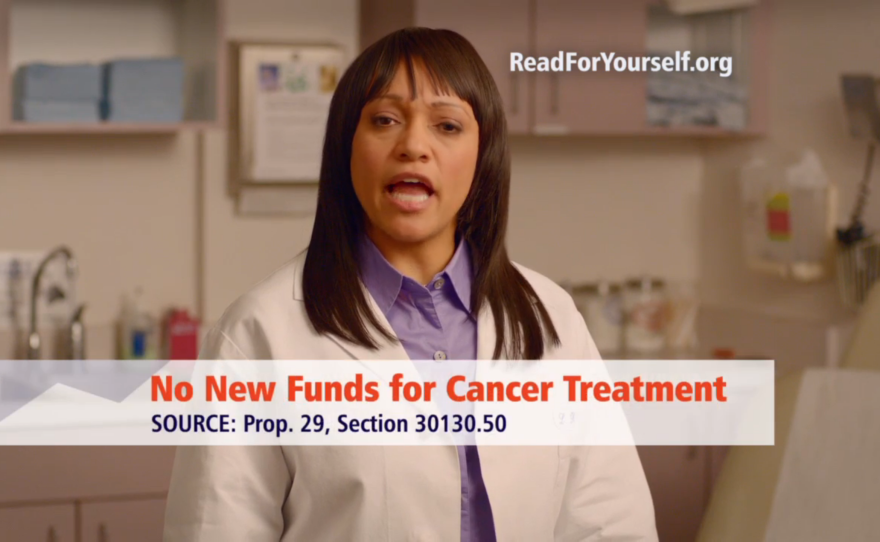

But television commercials against the measure show doctors in white coats saying, “not one penny goes to new funding for cancer treatment.” Ads for the measure show cancer patients saying, “if it wasn’t for cancer research, I might not be alive today.”

Jennifer Jacobs, a spokeswoman for the conservative political advocacy organization Americans for Prosperity, told KPBS she believes Prop 29 is “a flawed initiative.”

“It’s just another tax increase that creates a whole other bureaucracy that’s not accountable to tax payers,” she said.

If passed, the measure will establish The California Cancer Research Act Oversight Committee, a nine-member governing committee to administer the funds. But Jacobs said there is no taxpayer oversight of the funding.

“Of course we support cancer research,” she said. “What we want to make sure is the money that goes into the state coffers is accountable. And right now there is nothing in the state that is accountable.”

Debra Kelley, director of Advocacy and Health Initiative for the American Lung Association, California, which supports the measure. She said Jacobs’ arguments have nothing to do with Prop 29.

"You know listening to Jennifer's statements I really feel like I'm listening to the Marlboro woman," she said. "She's really spouting all of the lies and best representations that are being promulgated by the top tobacco industry."

“We have built in a lot of safeguards to protect this money from being stolen away by legislators because we understand the temptation that this represents,” Kelley added.

Kelley said the members of The California Cancer Research Act Oversight Committee will not be politicians and will oversee how the funding is doled out, and she said the state will hold yearly audits of the funding.

San Diego scientific researchers told KPBS they strongly support Prop 29 because their institutions could use the extra funding.

More than $11 million has been raised to support passage of the measure. Major donors included the American Cancer Society, Lance Armstrong Foundation, American Heart Association and New York Mayor Michael Bloomberg.

Opponents have raised more than $42 million to defeat the measure. Tobacco companies including Philip Morris and R.J. Reynolds were the biggest donors.

Governor Jerry Brown booted a doctor from a state advisory panel after she appeared in one of the television ads against the measure.

The last time a cigarette tax was on the California ballot was in 2006, when Proposition 86 was narrowly defeated. That measure would have imposed an additional tax of $2.60 per pack of cigarettes.