Everyone wants to make sure they’ve built up a good nest egg by the time they retire. Proposition B on the June ballot would freeze the base pay of current city employees for five years. But it would also change the city of San Diego’s retirement fund from a pension to a 401(k) system. The switch would apply to all new hires except police officers.

But how would it work exactly? Financial planner Gabriel Wisdom came to KPBS to help explain the basics of how Proposition B would change the city of San Diego’s retirement system.

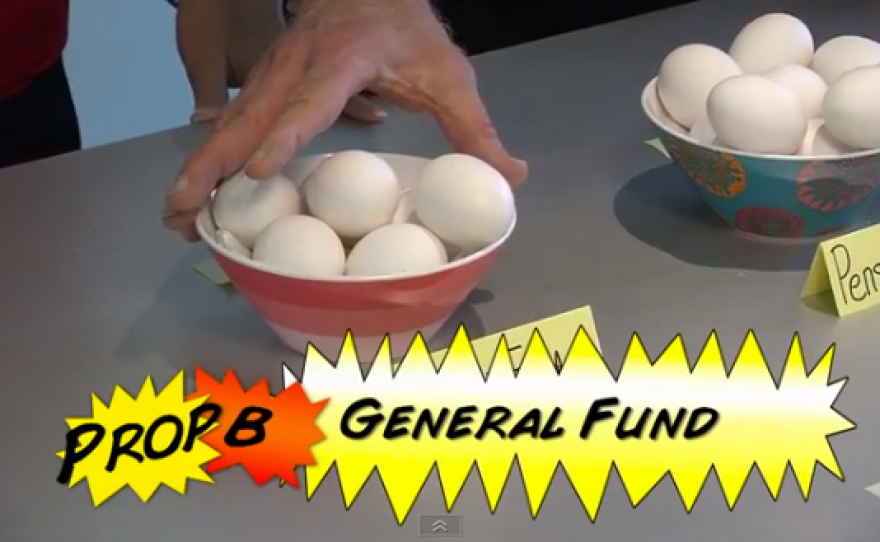

And he helped to explain the change using eggs. To start, picture three bowls of eggs sitting on a table in front of you.

“These bowls of eggs represent three different pots of money,” Wisdom said. “One represents the city’s General Fund, which it uses to do things like fix streets and provide city services. One represents the city’s pension fund, which it invests in the stock market in the hope it’ll grow. It then uses that money to give retirees the benefits they’ve been promised. And one bowl represents the retirement fund of the employees.”

Try to picture it. We have three bowls of eggs, which represent the General Fund, the pension fund and the individual accounts of retired workers. Currently the city has a defined benefit system. Wisdom describes how that works.

“That means that retirees are guaranteed a certain benefit,” he said, “which is determined mainly by the number of years an employee worked and the salary they got.”

For instance, let’s say an employee is promised four eggs a year for their rest of her life. The city has to give her those four eggs every year, no matter what. But let’s say something happens, like in the last few years when the stock market took a nosedive, and some of those eggs break. Suddenly there aren’t enough pension eggs left to cover the annual payment to employees. Wisdom said the city’s on the hook to replace them.

“Well, that’s where the General Fund comes in,” he said. “When there aren’t enough eggs in the pension fund, the city has to take eggs from the General Fund to cover the losses.”

Now imagine a bunch of eggs being taken from the General Fund bowl and being placed into the pension fund bowl. That means there are fewer eggs left to cover city services, which is one of the downfalls of having a defined benefit system. But it can work the other way too. For instance, in the coming year San Diego will pay $230 million toward the pension, which is less than expected because the stock market went up. But Wisdom said there is a way to avoid all these ups and downs…

“Switching to a defined contribution system would mean the city is not subject to the ups and downs of the stock market,” he said.

That’s what Proposition B is proposing.

“It would change the system so the city only guarantees an employee a certain contribution to their retirement fund, like a 401(k),” Wisdom said. “It doesn’t guarantee what will happen with that contribution.”

So, in terms of eggs, the pension bowl now becomes the 401(k) bowl. Let’s say the city commits to putting two eggs a year into the employee’s 401(k) fund while they’re working and the employee puts one egg a year in to their 401K. Under this plan the city’s contribution is limited and the employee has more control over how their money is invested. But what if the stock market crashes and a bunch of eggs of eggs break? Well, Gabriel said that’s on the employee…

“Under this new system the city only commits to making a certain contribution, it doesn’t have anything to do with what happens to that contribution,” he said. “The employee would have to deal with whatever gains or losses they take on the stock market.”

This is what a lot of people in the private sector went through during the recession. But there’s a difference. Most people in the private sector are enrolled in Social Security, and city employees currently aren’t.

“In the private sector, when the stock market tumbles and the eggs begin to fall, Social Security acts as a kind of safety net,” Wisdom said. “During their working lives, most people in the private sector, and their employers, have also been paying eggs into Social Security.”

And once workers retire they can count on getting a certain number of eggs back from Social Security.

But since right now neither city employees nor the city pay into Social Security, employees won’t get those eggs when they retire. Although Prop B supporters of say future employees could vote on whether they want to re-join the Social Security system, but those details have yet to be worked out.