California lawmakers are scheduled to vote on a $214.8 billion operating budget on Thursday, sending the plan to Gov. Gavin Newsom's desk with a focus on expanding access to health insurance while spending billions of new money on homelessness and housing.

Newsom will have 12 days to review the bill and is likely to veto parts of it. Lawmakers could override him, but the California Legislature has not overridden a governor's veto in decades.

Democrats control both houses of the Legislature, and they reached a budget agreement on Sunday. Here's a look at what it includes:

__

HEALTH CARE

Some low-income adults living in the country illegally would get government-funded health insurance. The budget makes adults between the ages of 19 and 25 eligible for Medi-Cal, which is California's version of Medicaid. The Newsom administration estimates it will cost $98 million to cover about 90,000 people.

Families of four earning as much as $150,500 a year would get help paying their monthly health insurance premiums. The budget includes $418.7 million to make California the first state to offer subsidies to people who earn between four and six times the federal poverty level.

People who refuse to buy health insurance would have to pay a tax. This used to be law nationwide as part of former President Barack Obama's health care law. But Republicans in Congress eliminated the penalty as part of the 2017 tax overhaul. California's budget proposal brings it back, estimating it will generate $317.2 million.

California's government-funded health insurance program for the poor and disabled would spend $17.1 million cover vision, hearing, incontinence creams and washes, podiatry and speech therapy. Those benefits were eliminated during the Great Recession about a decade ago.

California would seek the federal government's permission to extend a tax on the companies that manage the state's Medicaid program. If approved, it would generate $1.8 billion in savings for the state.

__

WILDFIRES

Following one of the most destructive and deadly wildfire seasons in history, the budget includes lots of money to bolster the California Department of Forestry and Fire Protection, also known as Cal-Fire. The funding includes:

$40.3 million to buy 13 new fire engines and hire 131 people to operate them, bringing the agency's fleet to 356 engines, including 65 that operate year-round.

$10.6 million to hire 34 heavy equipment operators so Cal-Fire can staff its 58 bulldozers all the time.

$4.5 million to hire 13 people whose job will be to gather intelligence for decision makers during a wildfire.

$13.1 million to accept seven used C-130 air tankers from the federal government. The state will get them for free but must pay to maintain and operate them.

__

EDUCATION

California would spend $12,018 for every student in K-12 public schools. That's an increase of $444, or 3.8%, over last year.

Now that recreational marijuana is legal, the state would use $80 million of the taxes on pot to pay for child care for low-income parents. The idea is if children are in child care there is less of a chance they will use drugs.

Students studying to be teachers could get grants of up to $20,000 if they promise to teach bilingual education, special education, science, technology, engineering and math — all subjects short of teachers.

The state would spend up to $300 million in grants to help school districts build facilities for full-day kindergarten.

__

TRANSPORTATION

Yes, California has a projected $21.5 billion surplus. But that doesn't mean you will get a break at the DMV. The budget passes on credit card fees to customers, a hit to their wallets but saving the state about $114 million.

__

WATER

Advocates say more than a million people in California don't have clean drinking water. The Newsom administration proposed a new tax to help fix that. Lawmakers rejected it. Instead, they decided to take about $100 million from a fund designed to reduce greenhouse gas emissions and use it to help distressed water systems.

__

PENSIONS

Public school districts have to contribute more than 18% of their payroll to the state retirement system. Some districts are struggling to make those payments. The state will spend $356 million to lower that contribution by about 1 percentage point next year. Long term, the state is spending $4.5 billion to pay down the teacher pension system's debt, which will eventually reduce rates by about 0.3% for districts.

__

PAID FAMILY LEAVE

A California program covers a portion of workers' salaries so they can take time off to care for family members or to bond with a new child. Right now, it covers six weeks. The budget would expand it to eight weeks. To pay for it, workers would pay an additional 0.1% tax. That's about $62 per year for the average worker, who earns about $62,000 a year in California.

__

HOMELESS AND HOUSING

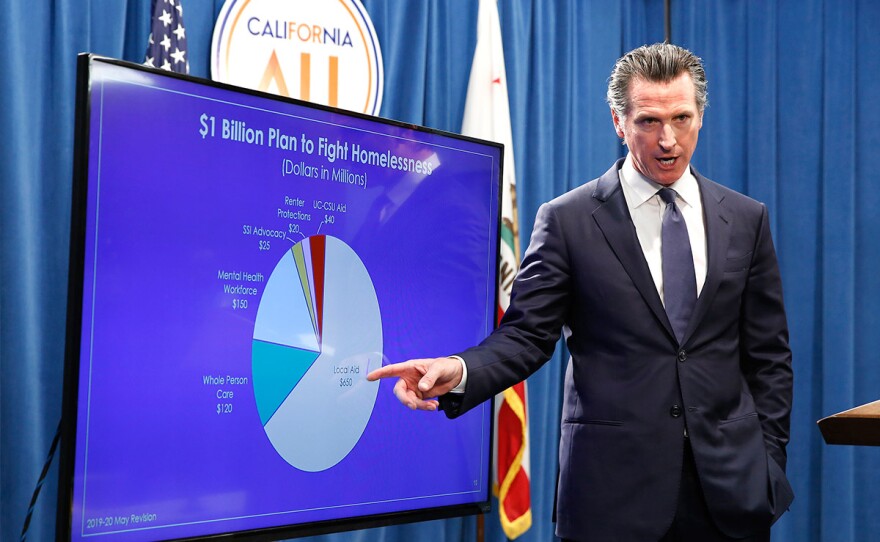

California's homeless and housing crises are linked, and the budget will spend $2.4 billion addressing those concerns.

The state would give $650 million to local governments. It would also pump $500 million into a tax credit program designed to spur construction of residential rental units.

There are creative uses, too. Few homeless shelters allow people to bring pets that are not service animals, forcing some homeless people to choose between their pet and shelter. Lawmakers will spend $5 million on grants to homeless shelters so they can accommodate pets.

__

MISCELLANEOUS

The budget would spend $5 million for suicide prevention measures on the Coronado Bridge in San Diego County.

It also seeks to end sales taxes on diapers and menstrual products with an exemption that would expire after two years.