Over the past years, Felipe Arevalo has noticed something concerning. He’s a community outreach coordinator for San Diego Financial Literacy, and when he reviews people’s budgets he sees one cost creeping higher and higher: car payments.

“It's making them put other things on hold, perhaps saving, which is important,” he said. “Or being able to purchase a home.”

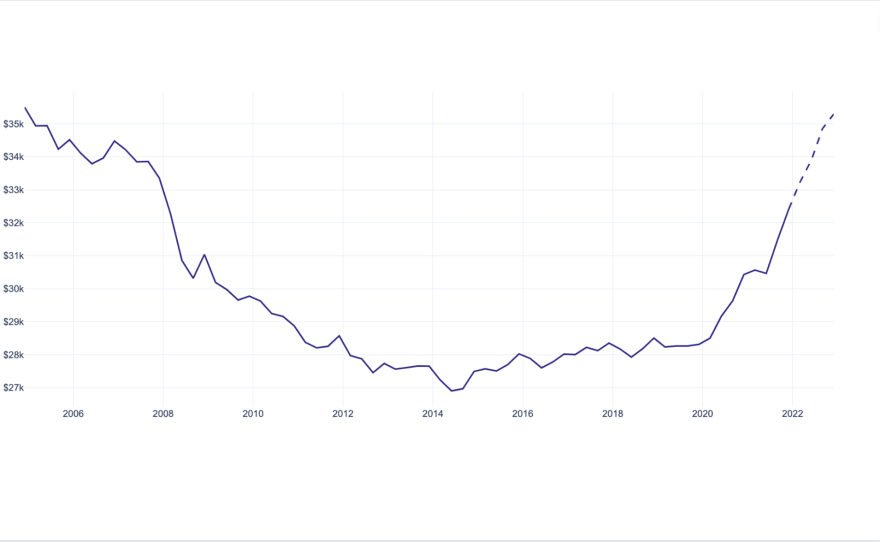

Arevalo is witnessing first hand what new data from the California Policy Lab show. The average amount for a new auto loan in San Diego and Imperial counties has grown by more than $10,000 since the start of the pandemic.

The price of used cars skyrocketed to historic levels during the pandemic, according to J.D. Power, and car loans grew in response.

To cover these larger loans, consumers are compensating by stretching out their loans over longer time periods. But that means paying a lot more interest over time, and a higher chance they’ll owe more than the car is worth, especially as used car values come down.

The number of people who miss a monthly payment is still low, but the number is increasing. And those delinquencies are more likely with longer loans, said Hisham Foad, chair of the San Diego State University Economics Department.

“The longer the amount that you're borrowing, there's more of a chance that something can happen that will lead you to be unable to pay back that loan,” Foad said.

Foad said he expects people to start holding onto their cars longer and to see an increase in car leases.

If people are struggling to make loan payments, Arevalo said the first step is to talk to the lender, who may have programs to help.

Car owners should review their budgets for items they might be able to cut, like a streaming subscription.

And if it’s available to them, Arevalo said they might consider refinancing their loan. But he cautions that right now they will be hit with higher interest rates.

He recommends potential buyers make a trial run before taking out one of these loans — start putting into savings what they expect their monthly payment to be.

“It'll help with down payment and it'll also prove to yourself that you have the ability to take on this new debt,” he said. “Just because you're approved for a certain amount doesn't mean your budget can handle it.”

For many, there is no choice but to buy a car because public transit does not reach their homes or isn’t fast enough.

“Some neighborhoods are going to be more car dependent than others,” Arevalo said. “And sometimes picking up and moving to somewhere where you're near public transportation is not an option.”

Until public transit improves in underserved areas of the county, more San Diegans might find themselves under the burden of these bigger, longer loans.