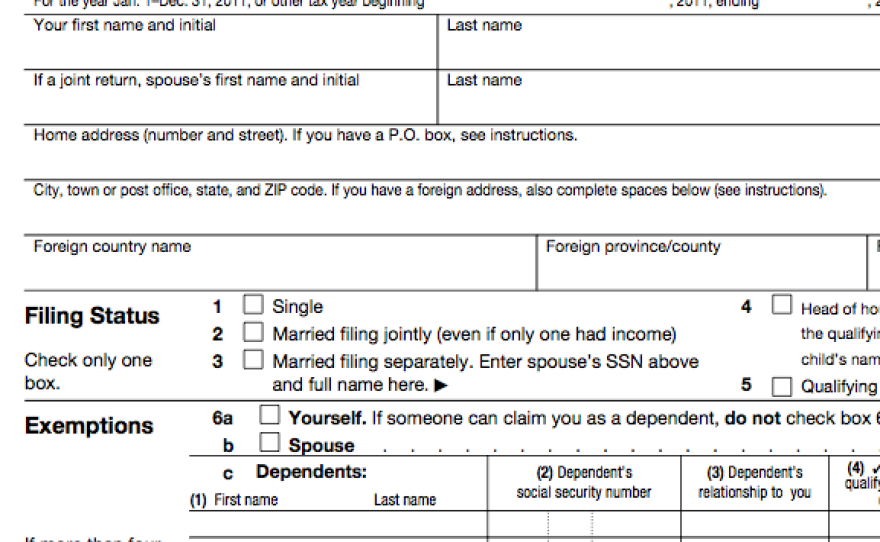

CAVANAUGH: This is KPBS Midday Edition. I'm Maureen Cavanaugh. You haven't even wrapped your Christmas presents yet. Why should you start thinking about doing your taxes? Well, there are lots of reasons. The biggest being what you do between now and the end of 2011 could seriously affect how much you have owe or what your refund is. Joining us with some tips is Rafael Tulino, a spokesman for the IRS. Welcome back to the show. TULINO: Thanks for having me. CAVANAUGH: We invite our listeners to join the conversation. 1-888-895-5727. As I said, people are running around, trying to get ready for the holidays. Are there some quick things we should do or check that could save us money on our 2011 income tax? TULINO: Right. And as you said at the top, are there's not too many people thinking about it. But if you do make some financial moves, and taxes are a bigger picture for a lot of folks in terms of what your financial snapshot is, then yeah, when you turn the -- and file in April, you find your income has been de-Reesed: And there are numerous rules and stipulations you want to stay by, if your goal is a legitimate tax reduction on your 1040 tax form. A lot of focuses don't bother with that. They're just giving because 't'is the season. But you want to be sure in you're getting a legit deduction, there are those rules. And you can look at your portfolio, you can did deduct your capital losses up to your capital gains plus $10,000. If you want to look at how that taxes on your return, you can do that. And other various thing, making sure if you want to contribute to your retypewriter plan, you do that because that's less of your money being taxed and more of it going to your retirement of the there's always different things out there. As you get to the end of the year, take a look at what can did onnor 1040 form so you legally based on your facts and circumstances decrease your bill as much as possible and or inacross your refund. CAVANAUGH: Is it too late in the year, let's say you have had a change in your status or your number of dependents and so forth. Is it so forth to change that, and as you say, legitimately, but let's say you've just had a baby, will it down for the whole year? TULINO: You know what's funny? I have a friend who has a kid who was born on January 1st. As long as the child was born in the cald year, you qualify for it. So that THOUSAND-DOLLAR credit or up to can be yours if the baby is born on December 31st, 8:00 in the evening. Or if it's done on, say, January 2nd for the next calendar year. So those kinds of things. And I have seen and -- not seen, but read a couple stories where folks have tried to induce to make that happen through the years. So that's just all part and parcel of it. CAVANAUGH: And I also heard that some people, if they think that for one reason or another, they may owe taxes for their 2012 income tax, that it might be a good idea this month if they can to make payments on their house for January or beyond. Can you do that? TULINO: Yeah, you can. If you want to make a 13th payment, so to speak. And realize that mortgage interest reduction on your return, that might be something you can do to increase your deductions. But that's an option. Other options I've read, and I won't give them as I spokesman for the agency, but as a financial person who might say, hey, let's consider deferring income, if you're a small business owner from 11 into 12. Or taken in 11, because maybe in 2012, the tax rates may go on up. We don't know what Congress may do. Is it and if we do get some legislation, we'll see what happens as things go. So those are -- that's why I said the bigger picture financially, here is a piece of it, and certainly as the days dwindle, take a look at it if you have the gumption. CAVANAUGH: My guest is Rafael Tulino, a spokesman for the IRS. And we're taking your calls at 1-888-895-5727. Patricia is on the phone from Escondido. Welcome to Midday Edition. NEW SPEAKER: Hi. Thank you. CAVANAUGH: You're welcome. NEW SPEAKER: This year we had credit card debt written off. And we believe that we can claim insolvency because we would be owing the amount that was written off: But we also are considering making a small donation, a charitable donation. And it seems to me that on the face of it, there might be a inflict there. TULINO: I think you're talking about two separate things. The first thing is the credit card debt could be subject to cancellation of debt income where you get a 1090 C. And then you talk about bankruptcy, and you get a whole different ball game in there. That's a different set of circumstances that you could face that could absolve you of that credit card debt. CAVANAUGH: NEW SPEAKER: Not bankruptcy. Insolvency. TULINO: I'm sorry, I apologize. But those things together might bundle up. But you can still make a donation if you itemize on IRS schedule A and realize a legitimate deduction if you wish. So there's two separate things going on there. One and the another. NEW SPEAKER: There's no conflict there in it seems to me if I'm claiming insolvency and yet making a charitable donation that -- TULINO: Not that I'm aware of, off the top. And I don't know all the facts around your whole situation tax-wise. You might want to consult a tax professional, depending on where that insolvency is going, and your whole picture. But as I'm listening to you now, it's two separate events in terms of what goes on your form. CAVANAUGH: Thank you for that. NEW SPEAKER: Thank you. CAVANAUGH: I think also what she's asking is that everybody -- when you have a form that's being analyzed by the IRS, is the whole picture taken into consideration? In other words if she says she's insolvent over here, and giving a charitable deduction over there, might that -- ring a bell? TULINO: It could be. It depends on your situation, where she's sat, there's a whole bunch of things, he's assets, liabilities, future income. All these different things that go together with it. I couldn't give a definitive answer. CAVANAUGH: More specific information is needed for her personal -- yeah. TULINO: Correct. And that's one of those where you say you might want to consult a tax professional to be sure. CAVANAUGH: We've knot another caller. Francisco is calling from Calexico. Welcome to the program. NEW SPEAKER: Yes? CAVANAUGH: Yes, hi, Francisco? Welcome to the program. NEW SPEAKER: Yes, my question is if the IRS accepts medical cannabis as receipts for medical expenses on our tax deductions. CAVANAUGH: Oh, I think that's a close one. TULINO: Unfortunately, Maureen just said it there, it's recognized as a schedule-one or schedule A drug. There are no deductions for medical marijuana. CAVANAUGH: And Francisco, I don't know if California was, but that would be a good question to ask your tax professional. NEW SPEAKER: Yes, and his answer is no? CAVANAUGH: No, because medical marijuana is not recognized by the federal government. NEW SPEAKER: And I just want to let the California people know the situation that it is. Thank you. CAVANAUGH: Thank you very much. In 2010, Rafael, people could take advantage of tax credits for buying a house. Is anything like that still available? TULINO: Not that I know of. In 2011 tax year, nothing that's on the books. But we'll see what happens. There are a bunch of things that are scheduled to sunset, so to speak, at the end of 2011. For example, the teacher deduction, and the sales tax deduction, the teacher deduction, if you're out of pocket, 250 for teachers who spend money out of their own pockets in the classroom, there's an opportunity to deduct up to $250 on your tax return. The sales tax deduction. You can choose to deduct sales tax or income tax if you itemize on Schedule A. That's still there we'll see what happens in 2012 for those. But the first-time home buyer credits and such, they all expired at the end of 2010. CAVANAUGH: I see. How about energy efficiency? TULINO: You can do that. And there's two different credits. I'll start with the one that's on the books till 2016, and that's going solar. This credit designed to spur investment in alternative energy. Such as solar water heaters, geothermal heat pumps, that's 30% of the cost with no limit if you do that to your home. The other one is the credit where you can, let's say, buy a new furnace, and/or insulation and winds. That's a lifetime credit of $200, it's 10% of the improvement costs that you make to your home. It's a decrease in what we saw from 2009 and 2010 on the recovery act. If you take the full amount of the credit for those two years, you wouldn't be eligible for the one in 2011. But if you're interested, type in the word energy efficiency and IRS.gov. And you can read all the stipulations and requirements and what's there for you. You have to do that in your main up home, in the United States , before the end of this year in order to qualify for the law. But the solar one is on the books for a few more years. CAVANAUGH: In order to qualify, though, do you have to just pay for it? Or do you actually have to have it installed pie the end of the year? TULINO: The words are placed in service. CAVANAUGH: Oh, I see. TULINO: So that means perhaps buying. If you're going to buy the furnace, for example, because it's cold now then you buy it, have that installed in your home and do so before January 1st. CAVANAUGH: We're taking your calls at 1-888-895-5727. %F01 Lorraine is calling from Carlsbad. Welcome to the show. NEW SPEAKER: Hi. I have a situation where I got married this year. And the gentleman that I married filed bankruptcy last year and lost his home. And it went into foreclosure. Now, my question is, am I responsible for any of his debt if there comes due a tax on his house that was foreclosed on? Because I hear that sometimes that happens to people even when they have a house that forechose said, they still owe the tax on it. And how do I stand when I file my taxes at the end of the year? Because he had filed for bankruptcy? TULINO: First thing is, there is something called innocent spouse and injured spouse. And you might qualify for that depending on T. When you're married, you guys pool together your financial, and you have to file married filing joint, or married filing separate. Everything you might do is run the numbers filing joint, then run them filing separate. If you file it separate, you might find it more beneficial depending on the situation. You have two options to take a look at things depending on where you are. But married filing separate, that might be something to look at, considering where you are. In terms of the situation as it is now. And then do check into the innocent injured spouse information, you can go to IRS.govabout that. But do run the numbers. CAVANAUGH: What about a foreclosure? Do people still owe taxes when they foreclose their homes? TULINO: For the -- per the law in 2012 is when is it expires, the mortgage debt forgiveness relief act of 2011 basically says if you have cancellation of debt for such, that could qualify for exclusion from tax paced on a principle residence here in the United States. If you get that debt forgiven from the lender, there is an opportunity if you're eligible and you're qualified to not have that taxed based on the cancellation of debt that comes from a foreclosure, or short sale, if you walk away from the home. CAVANAUGH: A lot of people are receiving unemployment benefits because of the unemployment situation in our economy right now. Is unemployment taxable income? TULINO: On a federal income tax return, yes. On the state level, and I'm just -- I'm almost sure it's not from the stateside of things. You'd have to check with the franchise tax board to be sure. But on the federal state, that's a taxable event. CAVANAUGH: Now, Rafael, you alluded to the fact that sometimes Congress waits till the very end of the year to enact legislation that impacts next taxes for 2011. Is there something you're waiting to see what happen in Washington? TULINO: Well, are the IRS as an administrative agency will act accordingly if they act in Washington. CAVANAUGH: I mean are you hanging around waiting to see what Congress is going to do? Is there anything that they're still deciding on? TULINO: If we see some legislation, then we'll act on it. And I'm sure there are some clairvoyant people in Dkeeping their ear to what bills are presented and what's going to upon ha. I'm reading a lot about the payroll tax cut that's on the books for 2011. Will it be extends and how is and when? We stand ready to act. Last year's law was passed on December 17th, so that was a tax relief act which extended certain things, and years previous, we have had legislation come along even later than that just before Christmas. So whenever and whatever that happens, the IRS will -- we will do whatever we can with the least burden to the taxpayer, so we can administer what Congress tells us to to. CAVANAUGH: As you said, a lot of people this time of year give donations. Is there a difference in how it's looked at in the IRS, whether it's cash or an actual material gift? TULINO: If it's noncash, like a household item as such, it needs to be in good condition. And that was per a law that was enacted in 2006. What is good condition? Filled imagine if you're going to donate a television, for example, it should be working. But cash and noncash items, no be Mr.. Put them on there. If you're giving to a qualified public charity, and you get that deduction for doing so, you itemize an IRS schedule A. The question is, what's the fair market value of it? You want to consider that. That's what you and me, Maureen, if you wanted to buy my TV, what would you pay for it? The reasonable demand kind of a thing. And if that was worth $25 to you, that's the information you put down on your tax return. There are also some websites out there that will help you determine fair market value for certain noncash items. But certainly you want to put that on this if you're taking a legitimate deduction. CAVANAUGH: In the past, the IRS has given some help for taxpayers who are having trouble paying thirds requirement taxes. Do you foresee that's also going to be extended to people who are struggling with their 2011 taxes? TULINO: Diagonal. We started with the posture in 2009, and we continued it. We realize a lot of folks out there are struggling to take care of their responsibilities. And be proactive, come to the agency, do file your tax return, do pay something. Then let us know the situation you're in. We'll work with you. We realize a lot of folks -- we would to be a help, not a henneder in that situation. We have that flexibility and that posture. CAVANAUGH: There's a very interesting thing I want to end on, and that is the idea that so many people now of course file their taxes electronically. And so they in a sense get their stuff to the IRS through use of the Internet. But there are some IRS Internet scams we have to be aware of it too. Does the IRS return our e-mail? TULINO: I guess the first thing is yes. Do get to a computer and do hit enter. It makes it so much easier. On the other hand, we are not making initial contact, unsolicited e-mails out of the blue that end up in your in-box about a refund, be it nominal or otherwise. A probe, a survey, an investigation. We don't send those e-mails to taxpayers doing that. Will if you're getting one of those, chances are it's a scam. Trying to take your information and do bad things to it to your good name. And just be careful if you're getting one of those e-mails. It's certainly not the IRS sending to you. CAVANAUGH: So if the IRS says you can increase your refund or they want some information from you, this is not really the IRS. ? TULINO: The IRS is not using e-mail for that. If you're getting contact with the IRS, chances are you're going to get a letter in the mail. If it's a taxpayer, you want to know about your refund and tax situation as such, and we have a -- we couldn't find homes for throughout the bad area due to bad addresses, go on IRS.gov, click on where's my refund, or call the agency and ask about where your refund is. But certainly once of those e-mails showing up in your box, chances are it's not the IRS doing so. And people are out there and they're coming from around the world using the IRS as a lure, so to speak to get you to enter into information that we'll never ask you for, personal, intrusive, or some malwear. If you click on this link. CAVANAUGH: I've been speaking with IRS spokesman Rafael Tulino. And I know we're going to talk to you next year. Thank you, Rafael. TULINO: Always enjoy it. Thank you.

You haven't even wrapped your Christmas presents yet, so why should you start thinking about doing your taxes?

There are lots of reasons. The biggest: What you do between now and the end of 2011 could greatly affect how much you owe, or what your refund will be.

Additiona Resources

We'll speak to an IRS representative on Midday to discuss tax tips that could reduce your 2011 tax debt.