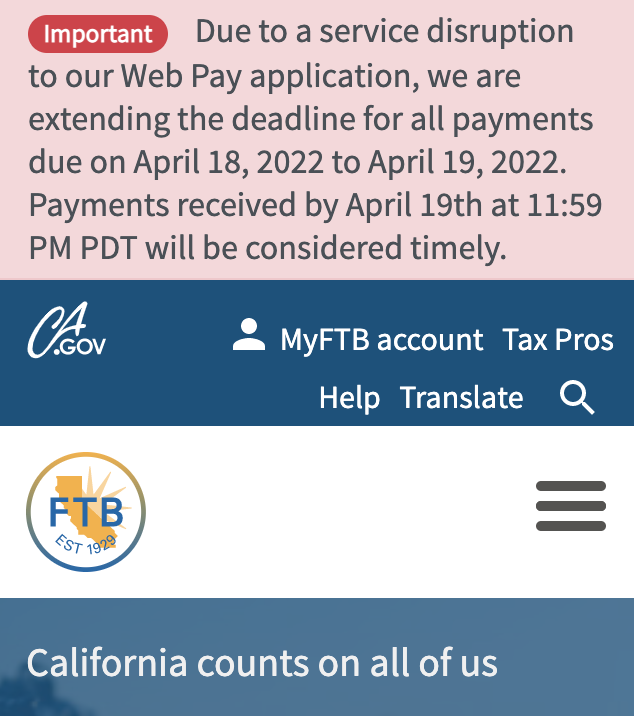

Update:

California's Franchise Tax Board announced Monday the deadline to pay 2022 income taxes has been extended due to technical issues with their payment application. The new deadline is 11:59 p.m., April 19, 2022.

Original story:

Tax procrastinators be warned — Monday is the deadline to get your taxes filed.

"It’s looming and it’s stressful ... sometimes we put it to the last minute, you know," said Martin Crespo from Chula Vista. He has an online business and said he needs help navigating all of the new tax rules. "With the pandemic right now there has been a lot of changes for online selling you know state and federal, it’s just like getting used to the new rules."

And making mistakes on his tax return is something he wants to avoid.

Fortunately for Crespo, there’s help and it’s free. Dreams for Change, a nonprofit that teaches financial literacy, set up tax prep pop-up locations throughout the county. He visited the location at the Plaza Bonita Mall in National City.

Carmen Ruiz, a volunteer coordinator for the program, said helping prepare returns is just part of what they do. "We’re basically here to not only do their tax return for free and get them as many credits as they’re allowed to get that belong to them but we’re also here to educate them on why they’re getting the return that they’re getting, why they owe money, what they can do to help themselves for next year."

RELATED: Many countries are seeing the worst inflation in decades

They offer assistance year round, but the pop ups are open until 8 p.m., and you must file your return by midnight to avoid penalties.

Ruiz says this day is always busy and the pandemic has also had an impact. "It’s been very busy, it’s been very busy because of the stimulus — we’ve been seeing a lot of people that normally don’t have to file come in to file because they can get that $1400 stimulus."

She noted something new this year: The earned income tax credit rules have changed. Many who typically would not qualify for that tax break do.

But the big question Ruiz said most people have this year is about stimulus money. "A lot of people are wondering, did they receive it, did they not receive it, if they didn’t receive it how do they get it?" she said.

If you have to pay back taxes or need to file an extension that pushes the deadline until October, they can help you with that too.

"It’s not as scary as it seems to get your taxes done, it really isn’t," said Ruiz.

The Internal Revenue Service began accepting 2021 tax returns in January. And while Tax Day is normally April 15, Monday marks the third year in a row the Internal Revenue Service has extended the filing date for federal tax returns.

Because of the COVID-19 pandemic, the deadline for tax returns in 2020 was extended to July 15. The federal government extended the tax deadline again last year to May 17. This year, the deadline has been pushed forward because of Emancipation Day, a government holiday celebrated in the District of Columbia.

Last-minute filers will need to submit their 2021 tax returns by Monday or request an extension, which would give them six more months to get their fiscal declaration in order.

An extension of time to file is not an extension of time to pay, however, and taxpayers must estimate their tax liability and pay any amount due by the filing deadline to avoid penalties and interest.

If you're owed a refund, there is no penalty for filing federal taxes late.

The IRS encourages taxpayers to file electronically because tax software does the calculations, flags common errors and reduces tax return errors by prompting taxpayers for missing information.

Even while your local post office may offer extended hours on Tax Day, the fastest way to receive a refund is to file electronically and use direct deposit, the IRS says.

IRS Free File is available to any person or family with an adjusted gross income of $73,000 or less in 2021. Most tax software providers make their online products available for free, and taxpayers can use IRS Free File to claim the remaining amount of their Child Tax Credit, the Earned Income Tax Credit and other important credits.

The IRS estimates 1.5 million taxpayers did not file a 2018 tax return to claim tax refunds worth more than $1.5 billion — and the three-year window of opportunity to claim a refund from that year closes Monday for most taxpayers.

If they don't file a 2018 tax return by the deadline, the money becomes the property of the U.S. Treasury. The law requires taxpayers to properly address, mail and ensure the 2018 tax return is postmarked by that date.

The IRS considers a tax return filed on time if it is addressed correctly, has enough postage, and is postmarked by the due date.

More information is available on the IRS website.

More information on Dreams for Change available at https://www.dreamsforchange.org/tag/free-tax-prep-san-diego/

-

As energy bills in San Diego rise so have profits for Sempra Energy, the company that owns San Diego Gas and Electric.

-

On Friday, San Diego Mayor Todd Gloria unveiled next year’s city budget, signaling a shift away from pandemic emergency planning.