Haiti has struggled to rebuild since a devastating earthquake more than four years ago. Most of the population lives on less than $2 a day and there are few open jobs for the millions of unemployed.

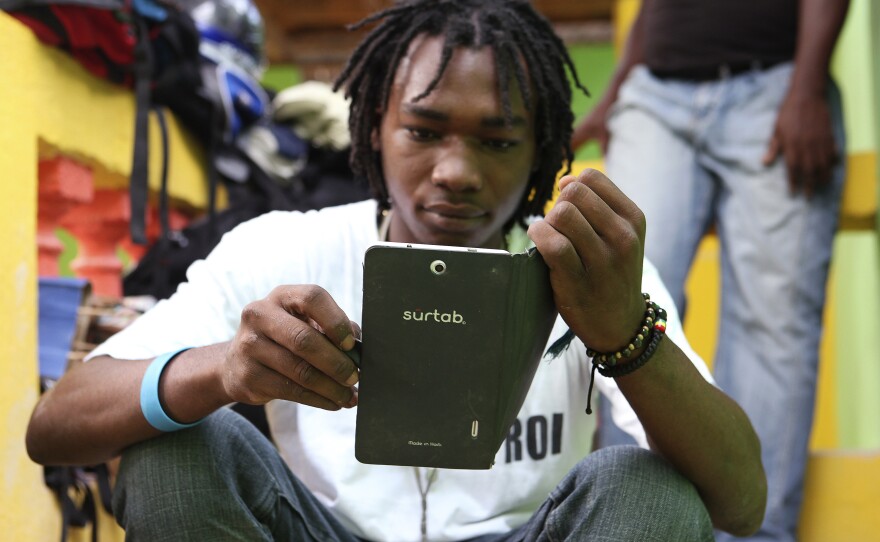

But there's a bright spot: The Western Hemisphere's poorest country is getting into the high-tech race thanks to Surtab, a Port-au-Prince-based company that makes Android tablets.

"Last month we [produced] 2,500. This month, as soon as we get components, we're now going to have a run rate of about 3,000-3,500," says Maarten Boute, Surtab's CEO. "So we're gradually ramping up."

Before the tablet business, the Belgian-born and Kenyan-raised Boute headed up Haiti's largest mobile company, Digicel. He says the combination of a booming population and the country's decent 3G network make Haiti a prime market.

"It wouldn't make sense in the smaller Caribbean islands, where your local market is not that big and where your diaspora is not that big either. One of our key next growth factors is that we'll start exporting from Haiti, fulfilled ... directly in Haiti ... to the diaspora," Boute says. "A lot of demand has come from there because people want to show that 'Hey, Haiti can do this.' "

Boute says Surtab, founded last year, won't make a dent in the global tablet industry. He's honing in on the developing world. One of his first orders was for 600 tablets for a Kenyan law school. About 90 percent of Surtab's sales have been in Haiti thus far.

Smartphones do exist in Haiti, but you're much more likely to see a stripped down mobile unit on the street. Tablets exist here, too, though they're prohibitively expensive.

Surtab offers three models: a low-level Wi-Fi version that retails for about $85. A step above is a 3G model that Boute likens to an iPad Mini in both look and function. It retails for about $150, and it's been the best seller. At the top of the chain is a 3G model with an HD screen, which sells for about $285.

The initial investment in the company was bolstered by a $200,000 grant from the U.S. government. And the Haitian government gave the company a five-year reprieve from duty taxes.

Despite the sweeteners, Boute says operating in Haiti still has its setbacks. There are slowdowns at the port, for example, a problem because the company imports its components from Asia.

"There can be times [things] get stuck for three or four days because a system goes down or a person isn't there to sign a document," Boute says.

Haiti once had a thriving assembly sector, says economist Kesner Pharel. In fact, Haitians sewed official MLB baseballs for Rawlings, but the company pulled out because of political instability. Pharel says Surtab won't create a tech boom, but still, he's excited about diversifying exports beyond garments.

Haiti's annual exports total about $800 million, while imports top $3 billion, he says.

Pharel says Haiti needs more jobs like the ones at Surtab to grow a middle class. With weekly competitive bonuses, the company pays between $10 and $15 a day, two to three times the minimum wage.

At Surtab's assembly facility at a warehouse near the Port-au-Prince airport, there are no assembly lines; each person is responsible for the assembly from start to finish. Workers wear white nylon jumpsuits over their clothes to prevent dust from getting into the air.

Senecharles Mardy is using what looks like a Dremel tool to heat and remove a cracked screen. She hadn't even heard of tablets before she heard about the company. Now she owns one of the devices, purchased with an employee discount. In a way, she's become an ad hoc sales associate, answering all the questions of curious friends.

"They ask me about the tablet — what it is and where I got it. I tell them where I'm working, and they say they'd like to have one, too," Mardy says.

Online orders are now being fulfilled in Haiti. Boute says his long-term goal is a 50/50 split between exports and local sales.

Copyright 2014 NPR. To see more, visit http://www.npr.org/