Critics of a new U.S. government regulation say it may put many banks across the Southwest out of business.

The new IRS regulation will make foreign investors report interest on deposits in U.S. banks — a move meant to bust tax evaders.

But critics say banks in border states will take a hit. Many depend on foreigners for as much as half of their capital flow.

U.S. Rep. Henry Cuellar, D-Texas, said Mexican investors will fear for their safety if their wealth is made public. The IRS could share their earnings with the Mexican government and corrupt employees could in turn pass the information to criminal organizations.

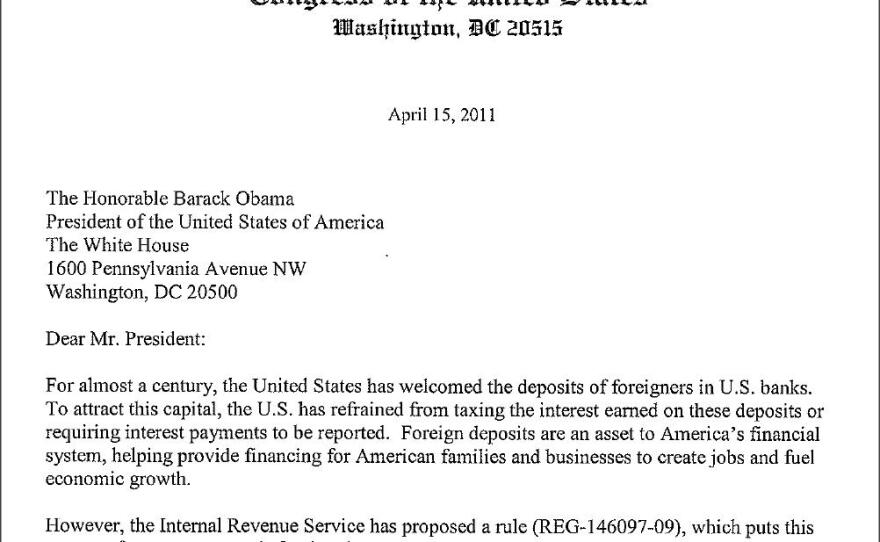

“Those Mexican depositors will say you know what U.S., if you’re going to be doing this, we’re going to turn around and go to another country — Cayman Islands, Switzerland — and we’ll leave the money there,” said Cuellar, who joined other South Texas congressmen in a letter to the Obama administration, asking that the new policy be rescinded.

The IRS insisted personal information will not be jeopardized because any country making a request would have to adhere to strict treaty regulations.

The tax agency also dismissed warnings such as a report saying the U.S. would lose $88 billion under the regulation.

“The claim isn’t supported by our past experience so we do not have concerns that that risk will materialize,” said Manal Carwin, deputy assistant secretary at the Treasury Department, which oversees the IRS.

The new regulation was first approved under President Bill Clinton but later withdrawn by the George W. Bush administration.

It is now set to take effect on January 1, 2013.