Bank of America announces it will acquire Countrywide in a stock deal valued at $4 billion.

Countrywide, the nation's largest mortgage lender, had few options after losses related to the subprime mortgage crisis. Analysts believe the company faced bankruptcy if it didn't work out a deal to be acquired.

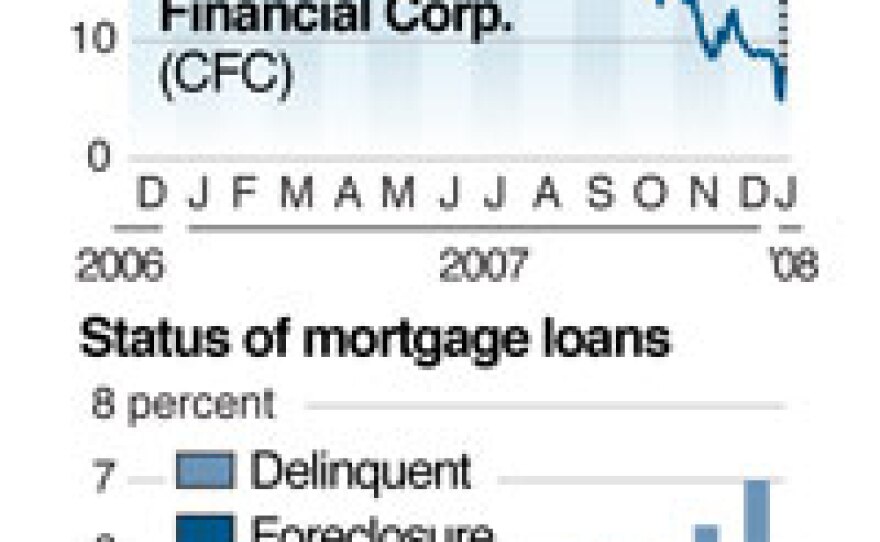

Shares in Countrywide hit record lows in recent days on persistent rumors that a bankruptcy was imminent, a condition brought on by the widespread spike in mortgage defaults and foreclosures, especially in subprime loans — those made to borrowers with weak credit.

By buying Countrywide, Bank of America is keeping the industry and regulators from the messy task of figuring out who will take on the responsibility of collecting payments for the millions of U.S. home loans serviced by Countrywide.

Copyright 2022 NPR. To see more, visit https://www.npr.org. 9(MDAzMjM2NDYzMDEyMzc1Njk5NjAxNzY3OQ001))