Though the United States is still leading the world in research related to diseases, it is rapidly losing its edge, according to an analysis in the American Medical Association's flagship journal JAMA.

If you look at biomedical research around the globe, the United States funded 57 percent of that work a decade ago. The U.S. share has since dropped to 44 percent, according to the study published online Tuesday.

"At the same time support for biomedical research in the United States has wavered, global interest in biomedical research is increasing," wrote Dr. Hamilton Moses III, founder of Alerion Advisors, and his five co-authors on the paper.

China still lags far behind the United States in its medical research spending, but its effort has been growing at a blistering rate: 17 percent per year, between 2004 and 2011, compared with 1 percent per year for the United States. More Chinese citizens than Americans now work in fields of science and technology, the study says.

This 16-page "special communication," along with supporting documents published online, offers one-stop shopping for people who want statistics on the state of funding for medical research.

Although the economic analysis focuses on the dollars and cents, the authors note that medical research holds a much deeper meaning for many Americans.

"For any current or future patient, research provides hope," the scientists write. "For the researcher, unanswered biological and clinical questions are endlessly fascinating. For a company or its investors, new products and services promise financial return."

Biomedical research affects not only a nation's health, they say, but international competitiveness, too.

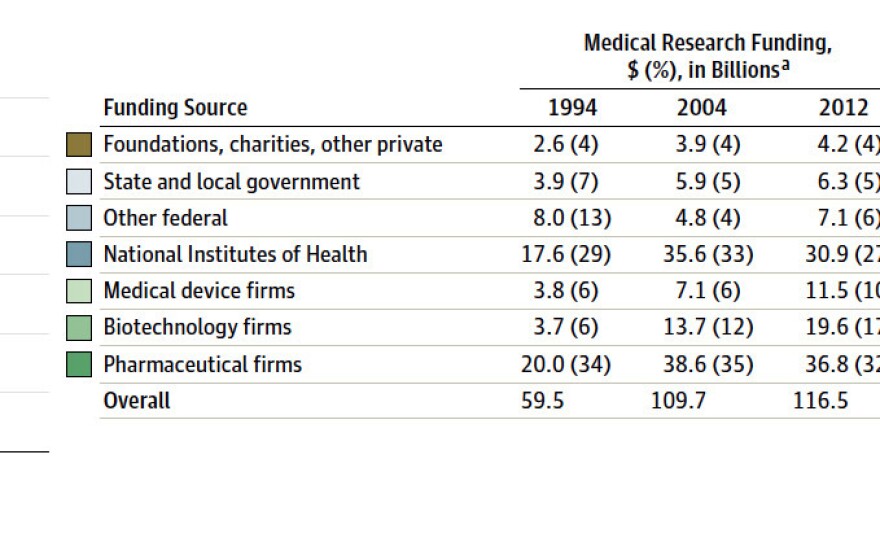

Shots readers may recall the stories we posted last fall about the effects of declining federal funding for biomedical research. That's just one piece of the story. The National Institutes of Health provides about $30 billion toward annual expenditures of $117 billion. That total includes funding from industry, foundations and other private sources.

And while $117 billion is a big number, it represents 0.7 percent of the nation's gross domestic product. At the same time, health care now makes up more than 17 percent of the nation's economy. The paper notes that there's comparatively little funding for research to make our health care system more efficient and less expensive.

Overall, industry has increased its spending on biomedical research, but that's not true for all endeavors. For example, pharmaceutical firms actually reduced their spending slightly between 2004 and 2012, the study says.

Drug companies spent less on the sort of early-stage research that aims to identify potential drugs, and comparatively more on human tests of safety and efficacy of drugs that are further along in the pipeline. Even so, the number of new drugs approved by the Food and Drug Administration is hovering around just 26 per year.

Medical device manufacturers and biotech companies have been areas of much more robust growth, the researchers find. Together, these two sectors account for 27 percent of medically oriented research in this country. That's similar to the NIH's share.

Moses and his colleagues join a chorus of scientists voicing concern about the United States' teetering support for medical research. "Given global trends, the United States will relinquish its historical innovation lead in the next decade," the researchers warn, unless there's a fresh infusion of public and private money.

"The main reason to increase expenditures on biomedical research and health services research is to capitalize on the investment already made in the past — to put that knowledge to work at the bedside, in real patients," Moses tells Shots.

Given the current political situation, Moses says, that will take creative new financial approaches, such as new bonds tailored for biomedical research. "We believe that this can fundamentally be funded by the private sector," he says, adding, though, that the government will continue to play a critical role in funding research that's simply too speculative and risky for investors to bankroll.

Copyright 2015 NPR. To see more, visit http://www.npr.org/.