President Obama on Wednesday unveiled an aggressive plan that aims to help up to 9 million homeowners avoid foreclosure, a major cause of the nation's financial crisis.

The president announced details of the plan in a speech in suburban Phoenix, where massive foreclosures drove down the median price of an existing home to $136,000 last month -- a 49 percent drop from 2006, according to The Arizona Republic.

The plan is designed to help homeowners whose mortgages exceed the value of their home and those who are on the verge of foreclosure. It includes $75 billion to cut the home payments of some homeowners and $200 billion from the Treasury Department to purchase preferred stock in Fannie Mae and Freddie Mac -- double what was originally pledged.

"Through this plan, we will help between 7 and 9 million families restructure or refinance their mortgages so they can avoid foreclosure," Obama said in remarks to a crowd at a Mesa, Ariz., high school. "And we are not just helping homeowners at risk of falling over the edge; we are preventing their neighbors from being pulled over that edge too -- as defaults and foreclosures contribute to sinking home values, failing local businesses, and lost jobs."

The announcement came shortly after the Commerce Department released even more bad news about the housing market. The government report showed that housing starts fell nearly 17 percent in January to a seasonally adjusted annual rate of 466,000 units, a record low. Applications for building permits, an indicator of future activity, also dropped.

The president's initiative calls for allowing 4 million to 5 million ineligible homeowners with mortgages through Fannie Mae or Freddie Mac to refinance their home loans at lower rates. To accomplish this, Obama said he would remove restrictions that prevent Fannie and Freddie from refinancing mortgages valued at more than 80 percent of a home's worth.

Housing Secretary Shaun Donovan stressed that homeowners don't need to be delinquent in payments to get help.

The plan also offers financial incentives for lenders to reduce the mortgage payments of as many as 4 million homeowners who are at risk of losing their homes. Under the $75 billion Homeowner Stability Initiative, lenders would cut mortgage payments to no more than 31 percent of the borrower's income.

"My plan establishes clear guidelines for the entire mortgage industry that will encourage lenders to modify mortgages on primary residences. Any institution that wishes to receive financial assistance from the government, and to modify home mortgages, will have to do so according to these guidelines -- which will be in place two weeks from today," Obama said.

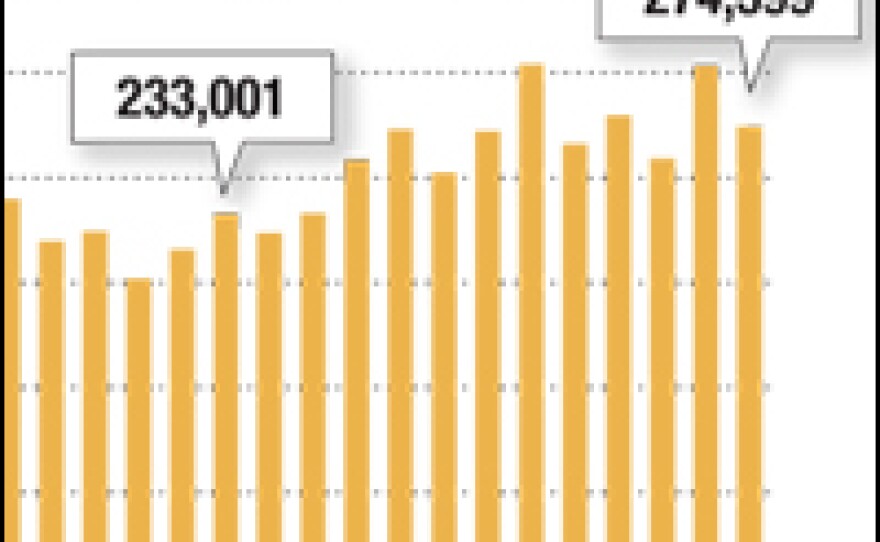

The plan is designed to aid homeowners and entire communities where double-digit foreclosure rates have led to declining properties and a shrinking tax base. Last year, there were nearly 3.2 million foreclosure filings -- including default notices, auction sale notices and bank repossessions -- on more than 2.3 million properties during 2008, an 81 percent increase in total properties from 2007, according to RealtyTrac, which tracks foreclosures.

The president stressed that the plan would not rescue speculators who made risky investments on homes to resell, dishonest lenders who distorted facts to get loans approved, or people who bought homes they knew they could not afford.

In addition, the Treasury Department announced it would provide up to $200 billion to Fannie Mae and Freddie Mac to stabilize the markets and hold down mortgage rates. In 2008, almost three-quarters of new home loans were financed or guaranteed by Fannie Mae and Freddie Mac.

"The increased funding will provide forward-looking confidence in the mortgage market and enable Fannie Mae and Freddie Mac to carry out ambitious efforts to ensure mortgage affordability for responsible homeowners," said a Treasury Department statement.

The president announced his housing initiative just one day after he signed a $787 billion economic stimulus plan that aims to create or save 3.5 million jobs. On Wednesday, he said part of the economic stimulus included $2 billion in competitive grants to communities looking for innovative ways to avoid foreclosures.

Copyright 2022 NPR. To see more, visit https://www.npr.org. 9(MDAzMjM2NDYzMDEyMzc1Njk5NjAxNzY3OQ001))