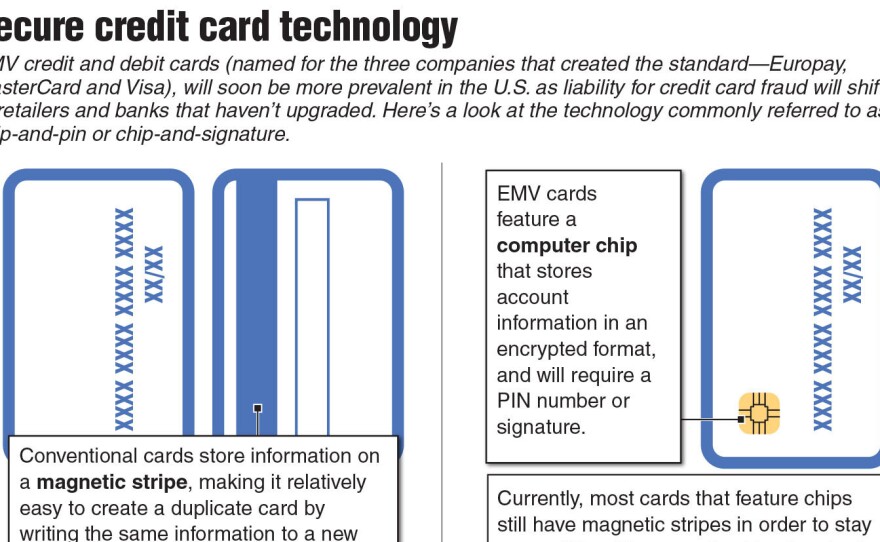

Today is the day — the beginning of the end for the venerable (but woefully open to abuse) magnetic stripe, a technology pioneered in the 1960s. Enter the more secure age of the chip, or "EMV" cards.

Or, at least in theory.

It's actually a bit more complicated. Here are three things to know:

Is today (Oct. 1) the deadline for the switch from magnetic-stripe cards to the chipped cards?

Yes and no. The Oct. 1 deadline was created by MasterCard, Visa, Discover and American Express to reduce or eliminate their exposure to credit card fraud. So, beginning today, merchants, rather than the credit card companies are liable for magnetic strip fraud. Martin Ferenczi, president of Oberthur Technologies, the leading global EMV product and service provider.

[You can read a history of the magnetic stripe here] Creditcards.com writes:

"Consider the example of a financial institution that issues a chip card used at a merchant that has not changed its system to accept chip technology. This allows a counterfeit card to be successfully used. "The cost of the fraud will fall back on the merchant," [Martin] Ferenczi, [president of Oberthur Technologies, the leading global EMV product and service provider], says."

So, the date is more of the start than the end of the process. According to a survey published earlier this month by Pulse, a Discover company, 90 percent of U.S. financial institutions either have begun issuing EMV cards or say they will do so by the end of the year. "Based on these plans, 25 percent of U.S. debit cards – approximately 71 million cards – will be migrated to chip by the end of 2015. The percentage is expected to rise to 73 percent by the end of 2016 and 96 percent by the end of 2017," the Pulse survey says.

So far, 200 million payment cards have been issued with the embedded computer chips in the U.S. ahead of today's deadline, according to the Smart Card Alliance.

How do I use an EMV card?

It's only a little different than what you're use to doing with your old credit cards. The main change is that you'll be dipping the card rather than swiping it. Think of some of the newer ATMs — dip, then complete the transaction with a signature or a four-digit PIN. Then remove the card and complete the transaction. (Some of the cards are chip-and-signature, others chip-and-PIN)

But, in practice, it might not be so simple.

"Confusion about the use of the new cards is going to make lines longer during the holiday shopping season because the customer might be confused about how it works," Matt Schulz, senior industry analyst for Creditcards.com is quoted by USA Today as saying. "The employee at the checkout counter might be confused. And you add it all up and you could end up with some frustrated customers."

Will my old magnetic stripe card still work?

Yes. There's a magnetic stripe on the back of the new cards, so that technology will still work with merchants who haven't made the transition.

"[We] know, based on experience in other countries, it takes several years to get to critical mass. So we're seeing Oct. 1 as more of a kickoff toward increasing the momentum toward chip. People will still be able to use their (cards with) magnetic stripes," says Stephanie Ericksen, vice president risk products, for Visa, according to USA Today.

Copyright 2015 NPR. To see more, visit http://www.npr.org/.